U.S. President Donald Trump announced a finalized trade agreement with China, pending mutual approval from both him and Chinese President Xi Jinping. In a post on Truth Social, Trump stated, "OUR DEAL WITH CHINA IS DONE," emphasizing the "excellent" relationship between the two leaders.

The deal follows two days of high-level negotiations in London and builds upon a prior framework set in Geneva aimed at de-escalating retaliatory tariffs. As part of the agreement, the U.S. will gain access to China's rare earth minerals and magnets—resources critical for electronics and defense—while Chinese students will continue to have access to American universities.

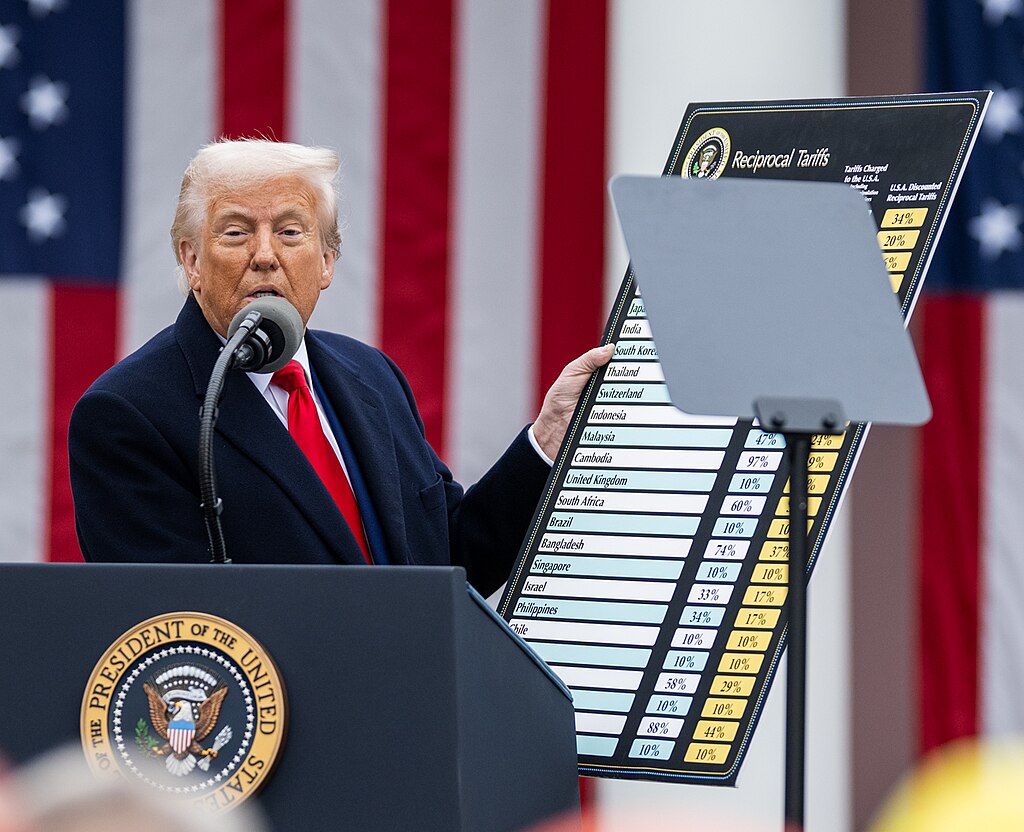

Trump revealed that the U.S. will impose a 55% tariff on Chinese imports, while China will maintain a 10% duty on American goods. This represents a formal shift from the previous tit-for-tat measures that had raised tariffs to unprecedented triple-digit levels on both sides.

U.S. Commerce Secretary Howard Lutnick praised the framework for adding "meat on the bones" to the Geneva discussions, which had faltered due to China’s restrictions on critical mineral exports. The U.S. had responded with new export controls targeting semiconductor design software, aircraft, and other advanced technologies.

The announcement brings cautious optimism to global markets, though concerns remain over Trump's unpredictable trade strategies and the long-term impact on global supply chains. Businesses hit by disrupted shipments and rising costs are watching closely for signs of regulatory stability. The deal signals a potential thaw in U.S.-China trade tensions, but its final impact hinges on formal ratification and consistent enforcement.

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition

Ghislaine Maxwell to Invoke Fifth Amendment at House Oversight Committee Deposition  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit