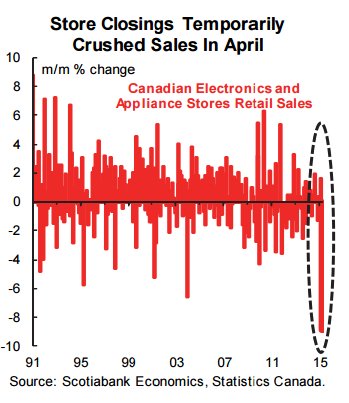

After all the excitement of the past week, Canadian market participants get a breather this coming week. Retail sales will be the lone macro release. Store closings have been temporarily fouling up the Canadian retail sales figures of late. That's one reason why it's premature to write off the consumer in Q2. Recall that sales fell slightly by 0.1% m/m in April, coming in well below consensus expectations for a gain of 0.7% m/m that had been based upon what was known ahead of time for some of the components. Also recall, however, that Future Shop announced that it was closing 131 of its Canadian stores with only half reopening the next week as Best Buy outlets. That probably explained the nearly 9% monthly drop in sales at electronics and appliance stores. Also recall that Target had been in a prolonged withdrawal from Canada following a failed international expansion effort. Controlling for this effect is more difficult because of the categories that may have been affected, and the multi-month liquidation of assets. Because the role of store closings may have just been a one-off adjustment, we might see a rebound in the May report. It's not clear that store closings represent a sustained negative signal for overall spending or a compositional shift as people possibly spend more on-line, at other new outlets, or on new products (e.g., photo memory cards versus prints).

If we get a retail sales rebound, then it will be another positive reading for the month. It would complement a picture of strength in the household sector as an offset to very weak manufacturing and export figures. We already know that housing starts were up 10% m/m (seasonally adjusted) via a 2% rise in singles and a 3.7% gain in multi-family homes. We also know that existing home sales climbed by 3.1% m/m in May, and that the country created about 59,000 jobs. Hours worked were up 0.3% m/m in May and then climbed to an all-time record high in June. That matters to GDP growth in that GDP equals hours worked times labour productivity (itself defined as output per hour worked). It's also possible that utilities output stabilized in May following a drop in April that itself came on the back of strong gains during a colder-than-normal winter across many parts of the country. On the downside, manufacturing sales volumes fell by 0.5% m/m and the trade picture was ugly with export volumes down 2.5% m/m and import volumes up 0.3%. Note, however, that the export figures are largely fabricated on the first pass at the energy sector because, by Statistics Canada's own guidance, it doesn't have enough company responses before the next months' revisions. If all of this (and next Monday's wholesale report) nets out to a modest gain in GDP then that will restrain bets that the economy contracted for two consecutive quarters. Indeed, small gains of a quarter of a percentage point in each of May and June are all that is necessary to prevent quarterly tracking of monthly GDP figures going negative.

"In our view, it remains unclear whether the BoC declared prematurely that the economy contracted in the second quarter especially with so much May and June data still ahead of us," says Scotiabank.

Tracking Canada's Q2 GDP Growth

Thursday, July 16, 2015 9:37 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX