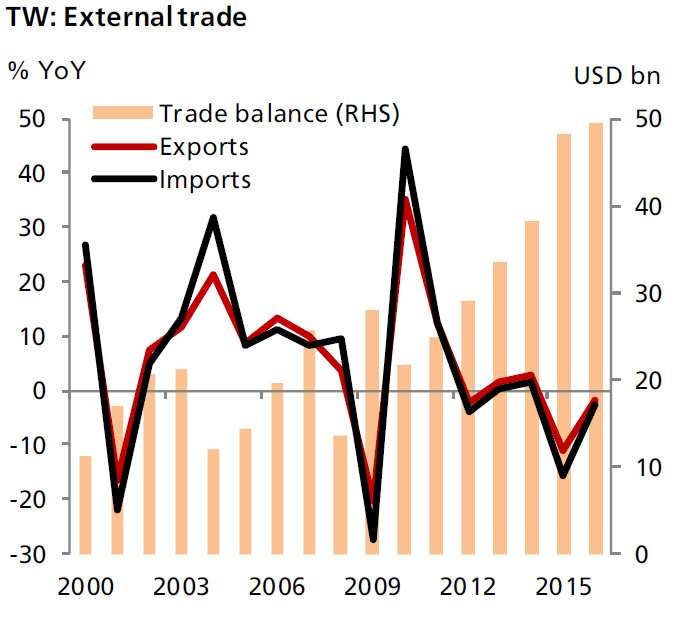

Taiwan trade surplus rose unexpectedly in December, rising to a seasonally adjusted annual rate of TWD 4.86 billion, from TWD 4.27 billion in November. Also, markets had expected trade balance to fall to TWD 4.20 billion.

Moreover, the country’s export maintained the double-digit rate of growth in December for the second consecutive month and quickened further to 14.0 percent y/y from previous 12.1 percent. On the other hand, import growth also bounced back to 13.2 percent from 3.0 percent in the meantime, with capital goods imports surging especially strongly by 34.1 percent.

It is worth noting that this data confirms that the Taiwan’s economic recovery is on the track, thanks to global rising inflation expectations and recovering economic growth. Also, recover in energy prices at the end of 2016 supported the cause.

But it is premature to anticipate a strong/smooth recovery ahead, given that global trade protectionism and China’s deleveraging/economic rebalancing remain the potential concerns, noted DBS Group Research.

In the full year of 2016, exports fell -1.7 percent, the second consecutive year of contraction. Looking ahead, chances are high that the annual growth in exports and imports will both turn positive this year. We currently look for 7.1 percent growth in exports and 9.9 percent in imports during 2017, which will generate USD 46 billion surpluses in the external trade balance, they added.

Lastly, we foresee that the annual GDP growth will not find any hurdle to reach 2 percent in 2017. Also, the pressure of capital outflows stemming from faster Fed hikes this year should be mainly reflected in the TWD/USD bilateral rate. On the relative basis, there are reasons to expect the TWD to stay resilient in 2017.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out