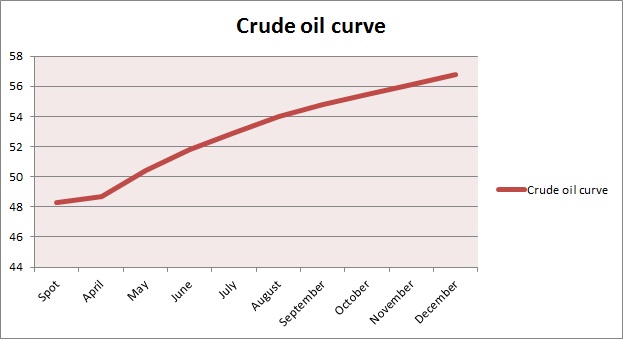

Supply concerns in crude have kept the spot prices lower moving the market in a contango.

What is contango?

- Very familiar term in the commodity market. Contango occurs when spot prices remain lower than future prices. This shows supply concern in future. Opposite is called backwardation.

Crude contango -

- As of current the crude oil market remains in contango as supply in present remains ample pushing the spot prices lower.

- Moreover reducing budgets by oil companies over new production have further pushed the contango on a higher side.

- Recent price action shows that with a fall in spit price the contango might get further on higher side. Prices in April fell by 1.33% whereas January 2016 delivery price fell only by 1.15%.

Implications -

- Companies and hedge funds might try to gain from selling the future and buying the spot.

- Major producers, who are not into financial contango play, might store the crude oil to sell at a future date at better price.

Caution -

- Contango play has always been a lucrative business. Profits were large during the super contango of 2008 that ultimately broke big time during the crisis. Contango over 6 months rose to $12.29 in 2008. Market finally moved to backwardation in 2011.

- US interest rate rise is sure to increase the cost of storage so the current contango may not be that lucrative until it rise further.

- Cost would further increase if the storage runs out and companies had to go for floating storage in super tankers.

Several changes in the oil market, calls to be cautious in time ahead. WTI is currently trading at $48.2/barrel, down by 0.20% for the day.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate