Stanford University reportedly expressed its intention to return all the gifts it received from the now-defunct FTX Trading Ltd. The California-based private research university is said to have funds from Sam Bankman-Fried’s collapsed crypto exchange firm, and the institution said these were mostly for pandemic-related prevention and research.

As per CoinTelegraph, Stanford University received a total of $5.5 million from groups related to FTX between November 2021 and May 2022. The university said it plans to hand back all the funds it got from the bankrupt crypto exchange firm.

This information was said to have been relayed by the university’s spokesperson via email on Tuesday, Sept. 19. Part of the statement from Stanford University reads, “We have been in discussions with attorneys for the FTX debtors to recover these gifts and we will be returning the funds in their entirety.”

Moreover, the educational institution also clarified that the “gifts” it received were from the FTX Foundation and other companies that have links to Sam Bankman-Fried’s crypto firm. In any case, the school may have been picked as a recipient since SBF’s parents - Joseph Bankman and Barbara Fried - are both former law professors at Stanford Law School. They were also said to be legal scholars before their teaching stint there.

Meanwhile, Crypto Potato mentioned that Stanford University decided to return the FTX gifts shortly after Sam Bankman-Fried’s parents were accused of misappropriating funds. Investors at FTX alleged that Bankman and Fried diverted millions of cash from the company’s funds for their own enrichment.

In response to the claims, the lawyer of the Bankman and Fried couple said the allegations are not true. The attorney described the move to involve SBF’s parents in FTX’s issues as a ploy to threaten the pair. “This is a dangerous attempt to intimidate Joe and Barbara and undermine the jury process just days before their child’s trial begins,” he said.

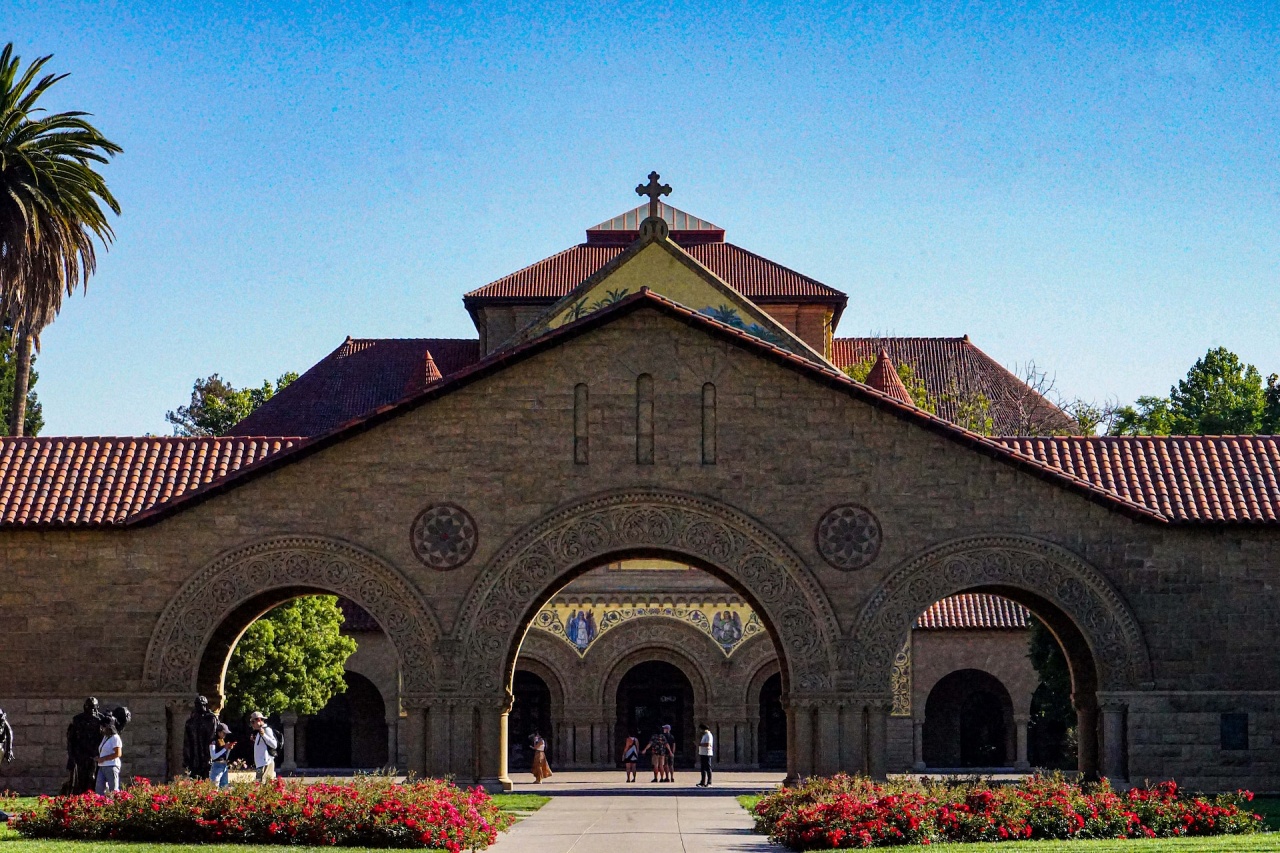

Photo by: Jeremy Huang/Unsplash

Gold Prices Rise as Markets Await Trump’s Policy Announcements

Gold Prices Rise as Markets Await Trump’s Policy Announcements  Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure

Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure  DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins

DBS Expects Slight Dip in 2026 Net Profit After Q4 Earnings Miss on Lower Interest Margins  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists

South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists  Reliance Industries Surges on Strong Quarterly Profit, Retail Recovery

Reliance Industries Surges on Strong Quarterly Profit, Retail Recovery  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Anta Sports Expands Global Footprint With Strategic Puma Stake

Anta Sports Expands Global Footprint With Strategic Puma Stake  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Why your retirement fund might soon include cryptocurrency

Why your retirement fund might soon include cryptocurrency  U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors

U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors