Industrial output in Singapore delivered a solid performance during the month of March, as electronics continued to remain in the driving seat.

Headline industrial output for the month expanded by 10.2 percent y/y. This is another strong showing following a revised 10.2 percent run in the previous month. On the margin, production level was up by 5.0 percent m/m (s.a.), after two consecutive months of decline. The strong run in manufacturing appears unabated and any concern regarding its sustainability will be kept under the carpet for the time being.

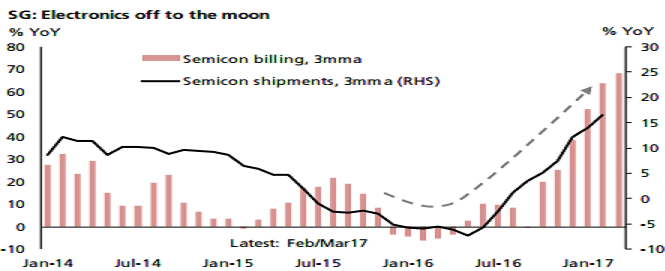

Production output was up by 37.7 percent y/y as indicators on global electronics cycle are reflecting an upswing in electronics demand. Both billings for semiconductor equipment and shipments of semiconductors are heading to the moon. However, the strong run in electronics is largely driven by consumer demand at present. Much will depend on companies increasing their capex in the coming months, which then provide the cluster with a second wind.

The main takeaway from the most recent set of IP figures is that 1Q GDP growth figures of 2.5 percent y/y will be revised upward. The Q1 2017 advance GDP estimates assumed a manufacturing growth of 6.6 percent y/y in the quarter. As it is, the sector has now expanded by 8.1 percent. This alone will add another 0.3 percentage point to the earlier GDP growth projection, which will be closer to our forecast of 2.9 percent.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks