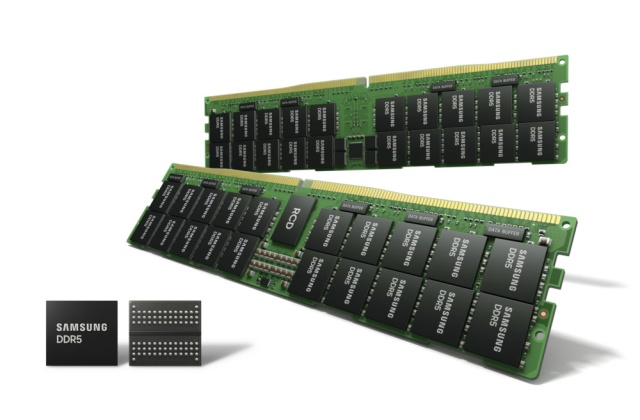

Samsung Electronics Co. is reportedly mulling on hiking prices for its chips. It is considering up to a 20% increase, and this was first reported on Friday.

The company is said to be currently in talks with foundry clients to mark up the contract of semiconductors this year, Bloomberg. With this plan, it is effectively joining an industry-wide push to lift prices to keep up with the rising costs of raw materials and logistics.

The contract-based semiconductor prices may possibly go up around 15% to 20%, depending on the chip products' level of sophistication. It was predicted that chips that are made on legacy nodes may have higher price increases.

Samsung has already finished negotiating with clients but is still in talks with others. Once everything has been agreed on, the new rates may be applied within the second half of this year.

Samsung was contacted by Yonhap News Agency, and its spokesman said that they could not comment on the matter yet as of this time. The company is currently the largest semiconductor producer in the world and Taiwan's TSMC trails in second place.

The Taiwanese chipmaker is also raising its prices between five to nine percent next year. This proves that price hikes are now an industry-wide trend due to the combination of high inflation and soaring costs of raw material costs.

As per Reuters, the Taiwan Semiconductor Manufacturing Company Limited or TSMC has predicted an up to 37% jump in its current-quarter sales as it is expecting chip capacity to remain very tight this year. It was also noted that chip shortage worldwide has also kept the company's book of orders full and more are still coming in. This situation and high demand allowed chipmaking firms to charge premium rates for their products.

Meanwhile, the United States President Joe Biden is set to visit Samsung Electronics' chip manufacturing complex in South Korea this week as part of his official state visit to the country.

A conference session with President Biden is also on the agenda and this event is hosted by the U.S. Department of Commerce and Korea's Industry Ministry.

Aside from Samsung, other major Korean companies were also invited to the business roundtable that was scheduled on May 21 and these are SK Inc., LG Electronics, Hanhwa Corporation, Lotte, Naver, Hyundai Motor, and OCI. However, some of them have not yet made a decision to attend, according to Korea Joongang Daily.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs