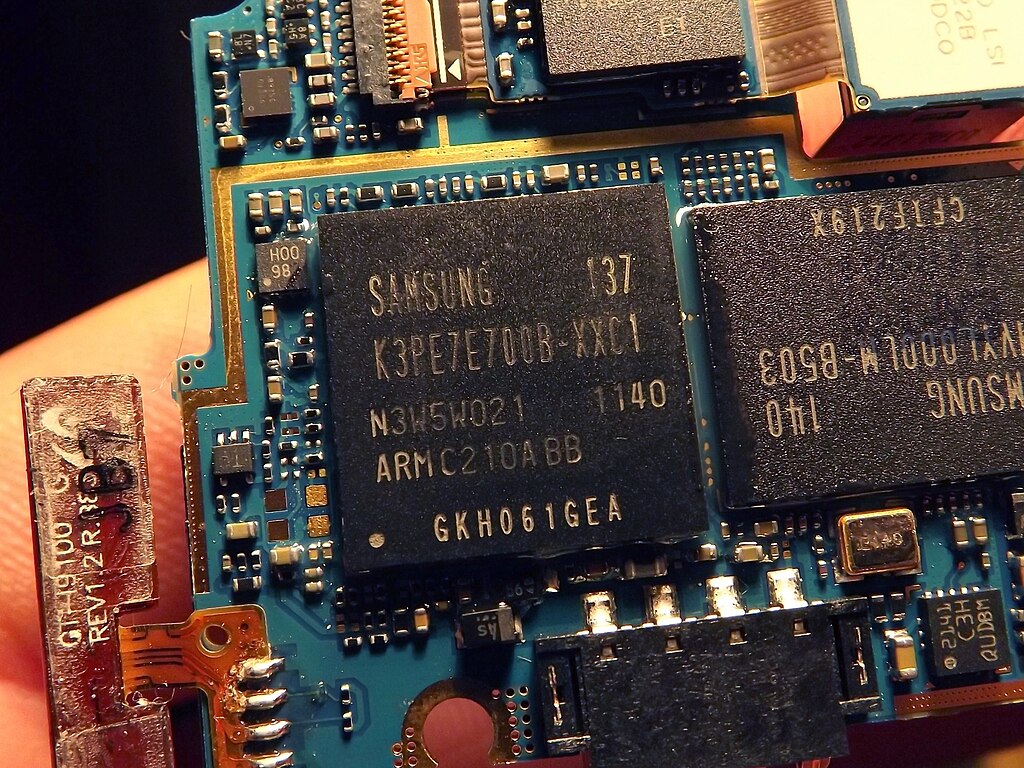

Samsung Electronics is preparing to begin mass production of its next-generation high-bandwidth memory chips, known as HBM4, as early as next month, according to a source familiar with the matter cited by Reuters. The advanced memory chips are expected to be supplied primarily to Nvidia, a key customer driving global demand for high-performance semiconductors used in artificial intelligence, data centers, and high-end computing applications.

While the source did not disclose the volume of HBM4 chips Samsung plans to deliver to Nvidia, the move itself signals a major milestone in the global memory chip race. HBM4 represents the latest evolution in high-bandwidth memory technology, offering faster data transfer speeds, improved power efficiency, and higher capacity compared to previous generations. These features are especially critical for AI accelerators and GPUs, where memory performance can directly impact overall system efficiency.

A spokesperson for Samsung Electronics declined to comment on the report, maintaining the company’s usual stance of not discussing specific customer relationships or production schedules. However, local media reports have added further context. South Korea’s Korea Economic Daily reported that Samsung has successfully passed qualification tests for its HBM4 chips with both Nvidia and AMD, citing unnamed sources within the semiconductor industry. According to the report, shipments to these major chip designers are expected to begin next month.

If confirmed, this development would strengthen Samsung’s position in the competitive HBM market, where it faces intense rivalry from SK Hynix and Micron. With AI-driven demand for advanced memory surging worldwide, securing supply agreements with industry leaders such as Nvidia and AMD could provide Samsung with a significant competitive advantage.

The timing is also notable as global chipmakers race to secure stable supplies of next-generation memory to support increasingly complex AI workloads. Samsung’s potential early entry into HBM4 production may help it capture greater market share while reinforcing its role as a critical supplier in the rapidly expanding AI and semiconductor ecosystem.

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans