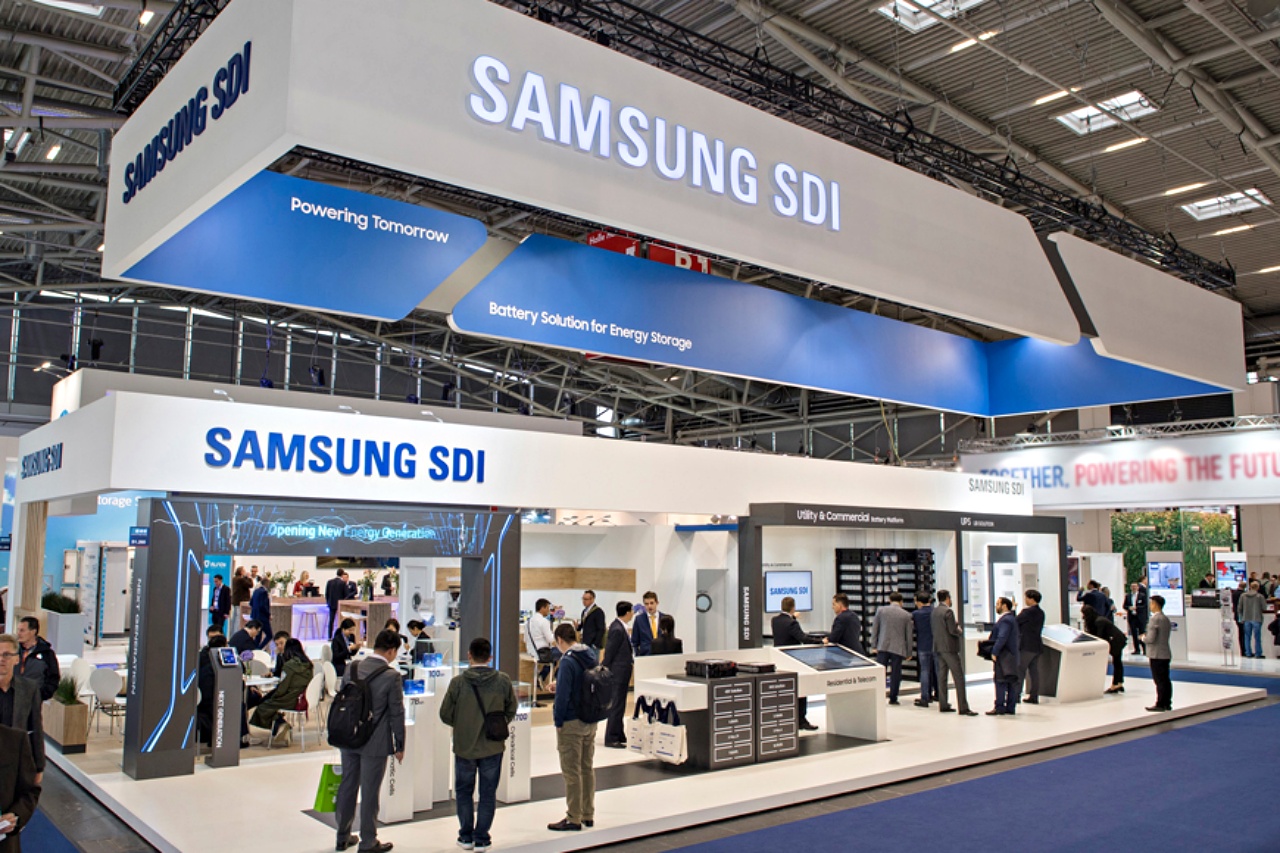

Samsung SDI announced that its U.S. subsidiary, Samsung SDI America, has signed a multiyear agreement to supply lithium iron phosphate (LFP) batteries to a major U.S.-based energy infrastructure company. The deal, valued at more than 2 trillion won (approximately $1.36 billion), marks a significant step in the company’s strategy to expand its footprint in the fast-growing energy storage system (ESS) market. Deliveries under the contract will begin in 2027 and continue for three years, reinforcing Samsung SDI’s long-term commitment to supporting clean energy solutions in the United States.

Although the customer’s identity was not disclosed, Samsung SDI described the partner as a leading developer and operator of energy infrastructure. The announcement sparked strong investor interest, with Samsung SDI shares climbing as much as 6.1% in morning trading, even as the KOSPI index slipped 0.1%. The surge reflects market confidence in the rising demand for ESS batteries, especially as global data centers, renewable energy projects, and grid stabilization efforts require more efficient and reliable storage solutions.

The LFP batteries involved in the contract will be produced using converted prismatic cell production lines at Samsung SDI’s U.S. facility. This shift aligns with the company’s broader strategy to adapt its manufacturing capabilities in response to evolving market conditions, including the transition away from certain U.S. subsidies for electric vehicle batteries. By repurposing EV battery production equipment for ESS applications, Samsung SDI aims to strengthen its competitiveness and capture new opportunities in the energy storage sector.

Samsung SDI, which already operates a joint venture EV battery plant with Stellantis in the United States, emphasized that ESS batteries share similar chemistry with automotive batteries, making the production transition efficient. As demand for renewable energy storage continues to grow, the company is positioning itself as a key supplier for next-generation power infrastructure.

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge