Bank of Japan at the start of the year reacted by surprisingly lowering its interest rates on part of the bank reserves into negative territory. In its September meeting, the central bank changed its monetary policy strategy. According to the new strategy, the BoJ switched to yield-curve control, rather than its already negative benchmark interest rate.

The BOJ said it would buy 10-year Japanese government bonds (JGBs) to keep the yield around zero percent while keeping a lid on short-term rates. While on the other side, it maintained the pledge to expand the monetary base until inflation exceeds the 2 percent target. Trump's win has sparked a global sell-off in bonds, which is testing the BOJ's ability to contain gains in yields under its new policy framework.

Trump's victory stoked expectations of huge fiscal stimulus, leading to generally higher growth and inflation. That sparked a sell-off in US Treasuries, dragging down prices and lifting yields for Japanese Government Bonds. This presents an early test of the BOJ's strategy overhaul. On Thursday last week, the central bank offered to buy shorter-dated bonds in unlimited amounts showing how the revamped framework aims to shield Japan from rising global yields.

Bank of Japan board member Takako Masai in a speech earlier on Monday expressed concern about sudden changes in financial markets given the backdrop of rising uncertainty about the global economy.

Inflation in Japan remains low and has even been negative again since March. In September even the core rate excluding energy and food eased back to zero again. BoJ once again had to postpone the time when it projects the inflation target to be reached; it now expects that inflation will reach the target of 2 percent during the fiscal year of 2018.

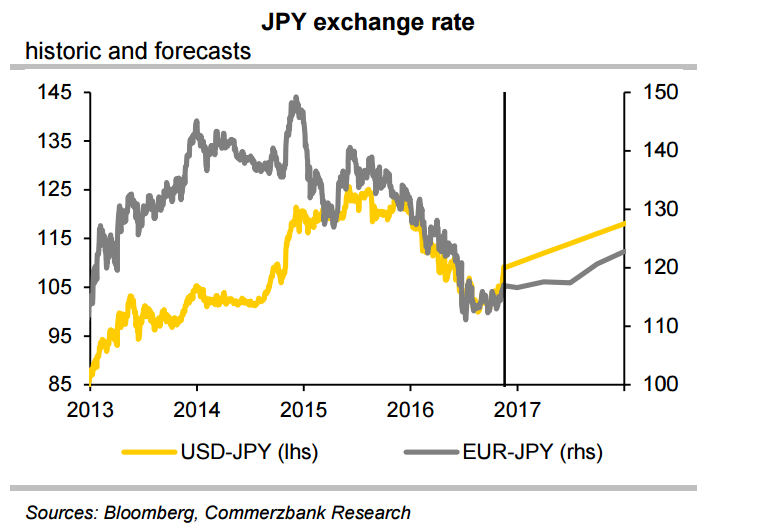

That said, JPY appreciation trend has paused. JPY exchange rates have stabilized. Most recently JPY was even able to depreciate notably mainly due to a stronger USD. Since the election of Donald Trump as US President-elect, the FX market is banking on a notably tighter US monetary policy so that USD is likely to appreciate further against JPY. Falling JPY exchange rate is likely to exert a positive influence on inflation expectations and reduce pressure on BoJ to act.

USD/JPY was trading at 110.66 at around 1145 GMT. At the said time FxWirePro's Hourly USD Spot Index was at 67.191 (Neutral) and Hourly JPY Spot Index was at -51.9838 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand