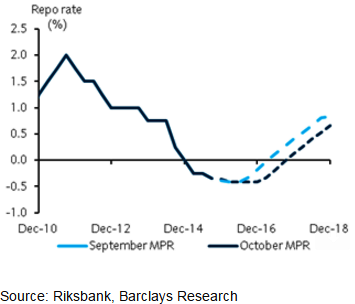

An additional 10bp repo rate cut in December after the ECB policy meeting, but remain of the view that the Riksbank is close to the end of its easing cycle.

Given the expectations for a time expansion of ECB QE in December and the Riksbank's recent reactivity to policy abroad, particularly in the euro area, the Riksbank will likely make policy more accommodative, cutting its repo rate by an additional 10bp shortly after the ECB's meeting in December.

"However, the need for additional policy stimulus will be a question and continue to think that the Bank is very close to the end of its easing cycle. The EUR/SEK forecasts remain intact, and a modest EUR/SEK depreciation is expected further ahead", says Barclays.

Riksbank likely to make policy more accomodative

Thursday, October 29, 2015 3:00 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook