'Impossible Trinity/Trilemma' is an economic concept which suggests that a country can’t all the three following at the same time; a fixed foreign exchange rate, free capital movement, and an independent monetary policy. And the ‘Trinity’ is back to haunt China again and this time around it has more firepower.

Why we say, ‘firepower’?

Simply because, this is not the first time China has faced the challenges of the impossible trinity and every time the country’s central bank (People’s Bank of China) has cleverly maneuvered its policy to avert the ‘Trinity’ disaster, which usually gets triggered by sudden explosion of volatility with either peg break or rise in the interest rates. However, every time, as China continued growing at a rapid pace, countering the Trinity under modernization and fixed exchange rate regime became difficult.

Brief history:

Due to these increasing challenges and to modernize its financial system, China de-pegged its currency from the U.S. dollar back in 2005 and since then it has gradually opened its economy to the world and reduced control over the capital account. However, PBoC still controls the volatility of the USD/CNY exchange rate by announcing a central point and the exchange rate is allowed to move within 2 percent band

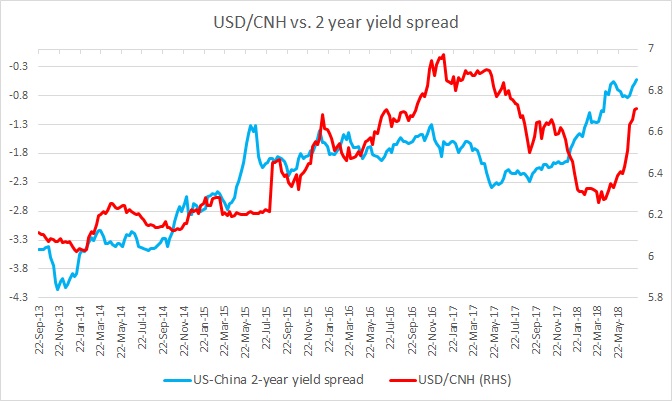

In modern day’s China counters the trinity using its vast foreign exchange reserve from time to time but recent history suggest that it is becoming increasingly difficult for the $11-12 trillion economy to counter the ‘Trinity’. In the above chart, look around March-August 2015 area, and you would see from the exchange rate movement that it was managed by PBoC, whereas the rate differential between the U.S. and China moved sharply in favor of the USD. After refusing to let the Yuan depreciate for several months, PBoC finally had to announce a one-time devaluation of the Yuan, leading to the biggest intraday selloff in the stock markets around the world.

Since the event, PBoC has further reduced its intervention in the foreign exchange market for a prolonged period.

The challenge now:

The figure above clearly suggests that the interest rate spread between China and the U.S. govt. bonds are in decline with the United States firing its all engines of growth and the U.S. Federal Reserve raising interest rates in response to a growing economy with the higher inflation rate.

It is happening at a time when the current U.S. administration has waged a war against China’s massive goods’ trade surplus with the United States, which reached $375 billion in 2017.

With the U.S. rates likely to increase further, the PBoC would either have to let the domestic interest rates rise, or let the yuan to depreciate based on market expectations.

We don’t expect the central bank, which has cleverly countered the trilemma over the decades to move aggressively and challenge. FxWirePro’s money is on letting the exchange rate depreciate as it would automatically counter some impacts of tariffs.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient