At its latest policy meeting, the Reserve Bank of New Zealand (RBNZ) left its OCR unchanged at 1.75 percent as widely expected. The RBNZ said that “global economic growth has increased and become more broad-based over recent months”, but “major challenges remain with on-going surplus capacity and extensive political uncertainty”, and “the level of core inflation has generally remained low”. Governor Wheeler reiterated his previous message that interest rates are expected to remain at 1.75 percent for the “foreseeable future”.

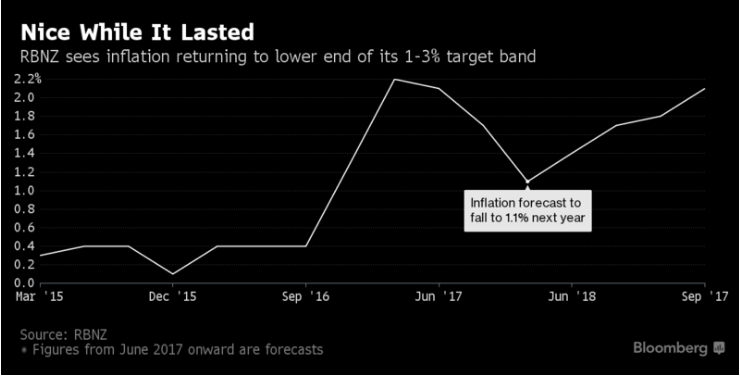

In its accompanying statement, the RBNZ viewed that developments since February were on balance “considered to be neutral” for the stance on monetary policy. RBNZ also noted “the increase in headline inflation was mainly due to higher tradables inflation, particularly petrol and food prices” which suggested the bank is not convinced that inflation pressures are building to such an extent that it needed to tinker with its flat interest rate track.

The RBNZ has revised up its tradables inflation forecasts, reflecting the lower New Zealand dollar since February. On the other side, the RBNZ has revised down its forecasts of domestically-driven (non-tradables) inflation over the next two years. The RBNZ has also finally acknowledged the slowdown in the housing market over the last six months, which will weigh on growth in household spending. Wheeler said that this moderation is expected to continue, although there is a risk of resurgence given the continuing imbalance between supply and demand.

"We are broadly in agreement with the RBNZ that domestic inflation pressures are still subdued, and that annual inflation will drop back below 2% next year as some temporary factors drop out. However, there are some aspects of the RBNZ’s forecasts that concern us. In particular, the RBNZ continues to gloss over the rebound in world dairy prices since the middle of last year. Consequently, we still think that OCR hikes will be later than what financial markets were pricing (March 2018), but earlier than the RBNZ is signalling (late 2019)," said Westpac Bank in a report to clients.

New Zealand’s economy expanded at a healthy clip through 2016, supported by record immigration and booming tourism and construction. Still, gross domestic product rose 2.7 percent in the fourth quarter from a year earlier -- less than the RBNZ and most economists expected. Growth will accelerate to 3.7 percent in the first quarter of 2018 from a year earlier, the RBNZ forecast today.

"The credit cycle is certainly buying the RBNZ time. We still believe that with the economy growing at trend (or thereabouts), inflation expectations lifting, headline inflation back at target, capacity pressures evident and tentative evidence that the wage cycle is turning, the day is approaching when the RBNZ will need to more seriously begin contemplating withdrawing monetary policy stimulus. We continue to pencil in a first hike in May next year," said ANZ in a research note.

New Zealand dollar slumped across the board on the RBNZ's dovish outlook. NZD/USD dived to multi-month lows at 0.6817 (levels unseen since June 3rd, 2016). The pair has recovered some losses and was trading at 0.6844 at around 0930 GMT. Strong trendline support is seen at 0.6820, while the pair finds immediate resistance at 0.6939 (20-DMA).

FxWirePro's Hourly NZD Spot Index was at -101.505 (Bearish), while Hourly USD Spot Index was at 124.463 (Bullish) at 0930 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing