At the board meeting held on February 7, the Reserve Bank of Australia (RBA) policymakers voted to leave the cash rate unchanged at 1.50 percent as they judged that it would be consistent with sustainable growth in the economy and achieving the inflation target over time. Minutes of the February RBA board meeting were released on Tuesday. The RBA continued with its broadly upbeat commentary in the minutes.

The RBA downplayed the contraction in GDP in the September quarter and said that Australia’s economic slowdown in Q3 2016 was likely temporary. The RBA noted that the nation’s third quarter contraction reflected some temporary factors, including disruptions to coal supply and bad weather. Australia subsequently recorded a large trade surplus, aided by resource exports in the following three months.

"Australia's low-cost producers of iron ore were expected to increase output further and the ramp-up in liquefied natural gas production was expected to make a significant contribution to output growth," the central bank said.

The bank forecast growth to pick up to around 3 percent in the year-ended terms later in 2017, and to remain above estimates of potential growth over the rest of the forecast period. Policymakers expect the underlying inflation to pick up gradually, largely reflecting the rising unit labor costs and the diminishing spare capacity. Further, the central bank predicts that rising resource exports in a more positive global environment will spur growth in Australia as the drag from falling mining investment wanes.

However, cautious comments prevailed on the labor market. The RBA warned subdued growth in household income was likely to constrain consumption growth. The central bank said spare capacity in the labour market will likely persist and consumption growth could be limited by subdued income levels. December quarter wages figures are due on Wednesday, which economists expect will continue to show annual growth sub-two percent and the lowest in at least two decades.

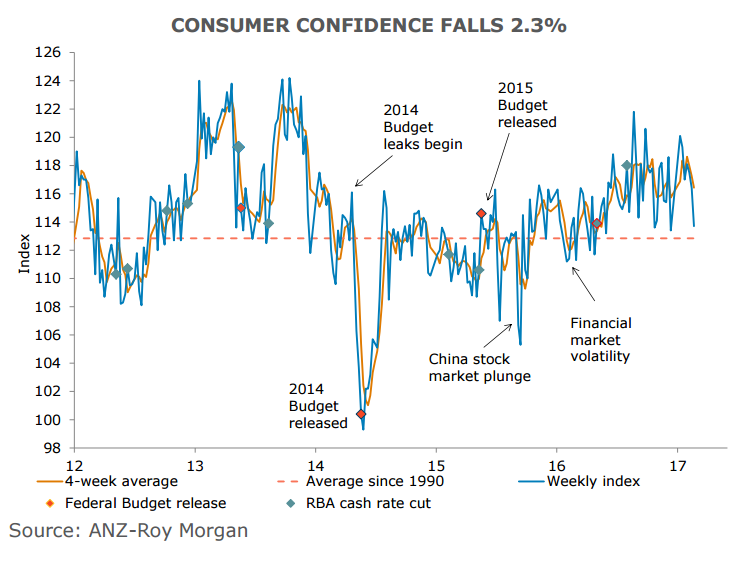

Earlier today the ANZ-Roy Morgan confidence index dropped by a further 2.3 percent to its lowest level since December. Sharp decline was seen in views toward current finances and also views on economic conditions over the next five years. Aussie left unimpressed after RBA minutes. AUD/USD down 0.33 percent on the day, trading at 0.7661 at around 1140 GMT. We see a potential 'Bullish Gartley' pattern on hourly charts raising scope for near-term downside. Completion of the 'Bullish Gartley' could open possibilities for long.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target