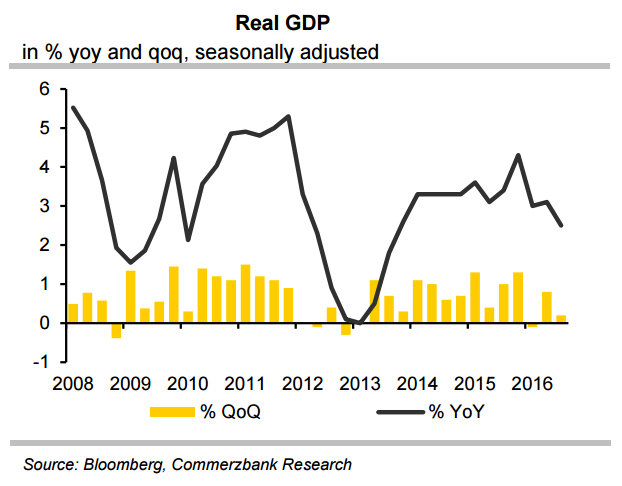

Poland's real economy disappoints significantly in 2016 and the downturn is likely to continue through 2017. Slump in private investment and weaker-than-expected household consumption are seen to be the main drivers behind the anaemic growth. In contradiction, policymakers claim that the pause in EU funds is the main reason for slowdown.

Poland's economic growth forecasts for 2016 were revised lower this week. Finance Minister Mateusz Morawiecki said the economy could grow by 2.5-3 percent this year, cutting a previous forecast of 3.4 percent.

"Latest data support our sub-consensus 2.4 percent growth forecast for 2016 and 2.7 percent for 2017. There is upside risk to our forecasts only in a scenario where the ECB manages to turn around the euro zone manufacturing cycle powerfully over the coming quarters" said Commerzbank in a report.

Poland's political risk perception remains fragile. The new PiS government holds a skeptical stance towards the EU and Russia and has signalled disinterest in adopting the euro. The rule of law probe has triggered a credit rating downgrade by S&P. There is also a looming risk of imposition of sanctions in worst case which could suspend Poland’s rights and privileges within EU or freeze EU funding.

Exports are no longer adding to growth and the helpful effect of falling energy prices have now run their course. Greater EU fund inflow is also likely to add only a mild pick-up in momentum in coming quarters. Deflation is likely to gradually fade in coming months, but is expected to remain well short of the central bank target through 2018. Below target inflation and disappointing growth is likely to keep National Bank of Poland (NBP) on an accommodative monetary stance.

"Direct rate cuts unlikely as a result of our less dovish view of the ECB. Rather, we think that a continued dovish stance from NBP, including perhaps Hungary-style QE policies, combined with a EM-negative environment globally will mean a weaker exchange rate – NBP will simply allow the FX channel to provide the additional stimulus," adds Commerzbank.

EUR/PLN was trading at 4.4903, while USD/PLN was at 4.2165 at 1230 GMT. At the said time, FxWirePro's Hourly USD Spot Index was at -30.4964 (Neutral) and EUR Spot Index was at 46.9312 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal