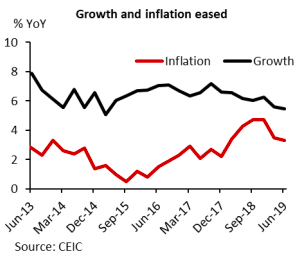

Philippines’ inflation is expected to remain at bay further this year, supporting private consumption, having stabilized from the peak in September-October to 1.7 percent in August this year, according to the latest report from DBS Group Research.

Soft domestic demand and high base effect from last year are likely to keep inflation around 2 percent until YE19. There are several risks to this outlook.

First, the government plan to increase the anti-dumping duties on rice planned for October might inflationary but is unlikely to push inflation above 2.2 percent for the rest of the years (rice weight in CPI is 9.6 percent).

Moreover, the substitution effect between pork and other types of protein should soften the impact to overall CPI. External headwinds to trade have caused growth to slow. Growth disappointed in 2Q recording 5.5 percent from consensus estimate of 5.9 percent, the weakest in 17 quarters, the report added.

Budget impasse earlier this year was the main cause of the growth slowdown alongside with higher global headwinds. In addition to the backloading of expenditure due to budget impasse, overall government infrastructure spending this year was cut by PHP95.3 billion.

This will negatively impact growth given that government infrastructure was the main driver of growth in the last three years. Moreover, despite significantly lower inflation this year, consumption has slowed in Q2. This slow down tallies with retail 1H earning results which recorded a double-digit contraction. Industrial production growth is still in negative territory.

"On a positive note, we think that growth might rebound in H2 although it is unlikely to rise above 6 percent," DBS further commented in the report.

Image Courtesy: DBS Group Research

Philippine Economy Slows in Late 2025, Raising Expectations of Further Rate Cuts

Philippine Economy Slows in Late 2025, Raising Expectations of Further Rate Cuts  Trump to Announce New Federal Reserve Chair Pick as Powell Replacement Looms

Trump to Announce New Federal Reserve Chair Pick as Powell Replacement Looms  Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions

Oil Prices Surge Toward Biggest Monthly Gains in Years Amid Middle East Tensions  Asian Currencies Trade Flat as Dollar Retreats After Fed Decision

Asian Currencies Trade Flat as Dollar Retreats After Fed Decision  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea Exports Surge in January on AI Chip Demand, Marking Fastest Growth in 4.5 Years

South Korea Exports Surge in January on AI Chip Demand, Marking Fastest Growth in 4.5 Years  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  U.S. Dollar Slides for Second Week as Tariff Threats and Iran Tensions Shake Markets

U.S. Dollar Slides for Second Week as Tariff Threats and Iran Tensions Shake Markets  Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets

Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets  Gold Prices Pull Back After Record Highs as January Rally Remains Strong

Gold Prices Pull Back After Record Highs as January Rally Remains Strong  U.S.–Venezuela Relations Show Signs of Thaw as Top Envoy Visits Caracas

U.S.–Venezuela Relations Show Signs of Thaw as Top Envoy Visits Caracas  South Korea Industry Minister Heads to Washington Amid U.S. Tariff Hike Concerns

South Korea Industry Minister Heads to Washington Amid U.S. Tariff Hike Concerns