U.S. stock index futures edged higher Tuesday evening, buoyed by optimism ahead of Nvidia’s earnings report and a combination of positive trade and economic developments. Futures gains followed a strong session on Wall Street, driven by President Donald Trump's delay of proposed tariffs on the European Union and a rebound in U.S. consumer confidence.

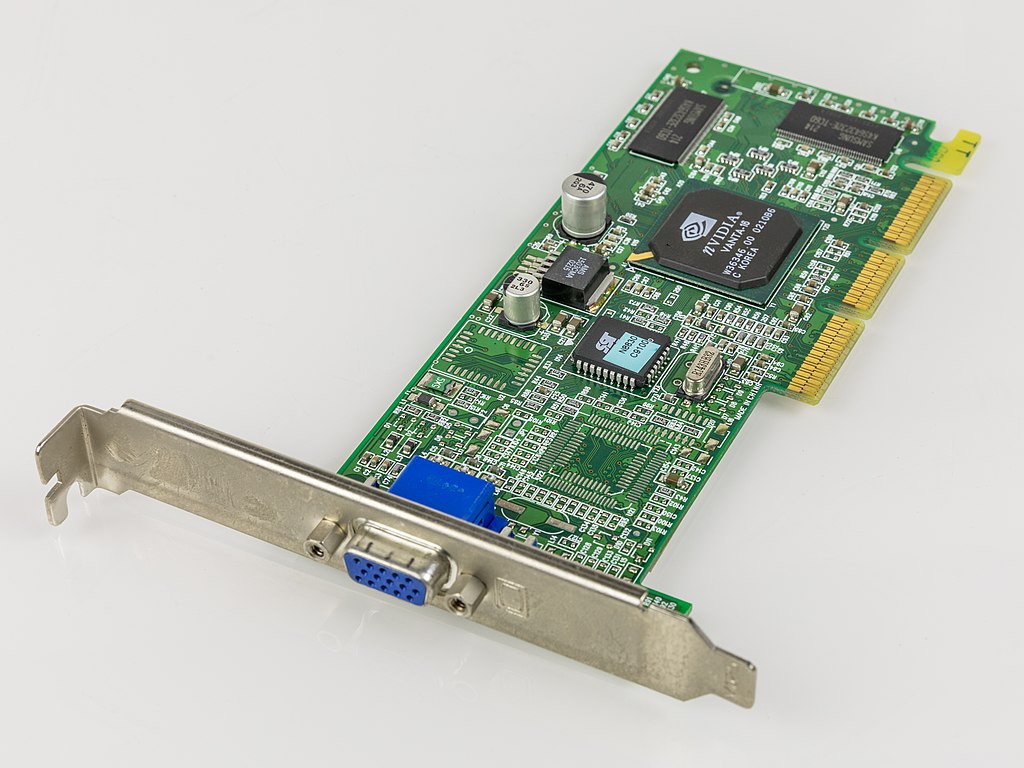

S&P 500 Futures rose 0.1% to 5,939.75, Nasdaq 100 Futures added 0.1% to 21,476.75, and Dow Jones Futures climbed 0.1% to 42,465.0 as of 19:14 ET. Tech stocks led gains, with Nvidia (NASDAQ: NVDA) jumping 3.2% in regular trading and holding steady after-hours. Investors are anticipating robust Q1 earnings from the AI chipmaker, which is expected to report earnings per share of $0.893 on revenue of $43.12 billion, driven by strong demand from hyperscale data center clients.

Nvidia’s outlook will be key for broader tech sentiment, particularly amid heightened U.S. export controls affecting sales to China. CEO Jensen Huang recently criticized these restrictions, forecasting China to eventually become a $50 billion market despite rising competition.

Meanwhile, Wall Street surged earlier in the day, with the S&P 500 gaining 2.1% to 5,921.54, the Nasdaq jumping 2.5% to 19,199.16, and the Dow climbing 1.8% to 42,343.65. Trump’s tariff delay softened fears of a trade war escalation, while May’s consumer confidence data—rebounding after five months of declines—bolstered optimism around economic resilience. The easing of trade tensions with China and ongoing negotiations with global partners further improved market sentiment.

All eyes now turn to Nvidia’s earnings, which are expected to set the tone for the AI and semiconductor sectors moving into the second half of 2025.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off