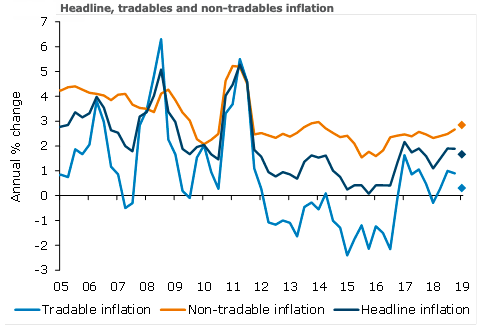

New Zealand’s headline consumer price inflation is expected to rise 0.3 percent in the March quarter, with annual inflation slipping from 1.9 percent to 1.7 percent. Tradable inflation is expected to print at -0.6 percent q/q, while non-tradable inflation is expected to post a 1.1 percent q/q rise, according to the latest report from ANZ Research.

CPI in line with expectations would add to the case that a cut in the Overnight Cash Rate (OCR) is not a matter of urgency. The Reserve Bank of New Zealand (RBNZ) would likely take some comfort from stronger domestic inflation (lifting from 2.7 percent y/y to 2.8 percent), with weakness concentrated in the relatively volatile and transitory tradable component.

However, the medium-term outlook for domestic inflation remains troubling. The central bank needs to see accelerating GDP growth to achieve a sustained lift in inflation, and by August it is expected to be clear that an OCR cut is required to support this.

Further, non-tradable inflation is expected to post a 1.1 percent q/q rise, consistent with the RBNZ’s February expectations. This would see annual non-tradable inflation increase from 2.7 percent to 2.8 percent.

The strong non-tradable print comes from seasonal strength in regulated prices, such as tobacco and education, as well as increases in housing-related prices. Core inflation has increased over the past year, but the suite of core measures is seen to track broadly sideways from here.

"While we are expecting a lift in non-tradable inflation next week, the medium-term outlook remains troubling. The economic expansion is losing steam, the global environment is no longer a tailwind, and the peak in capacity pressures appears to be behind us. Domestic inflationary pressures appear fragile, with early signs of waning capacity and cost pressures. The RBNZ needs to see accelerating GDP growth to achieve a sustained lift in inflation, and they are running out of growth drivers to achieve this," the report added.

Image Courtesy: ANZ Research

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022