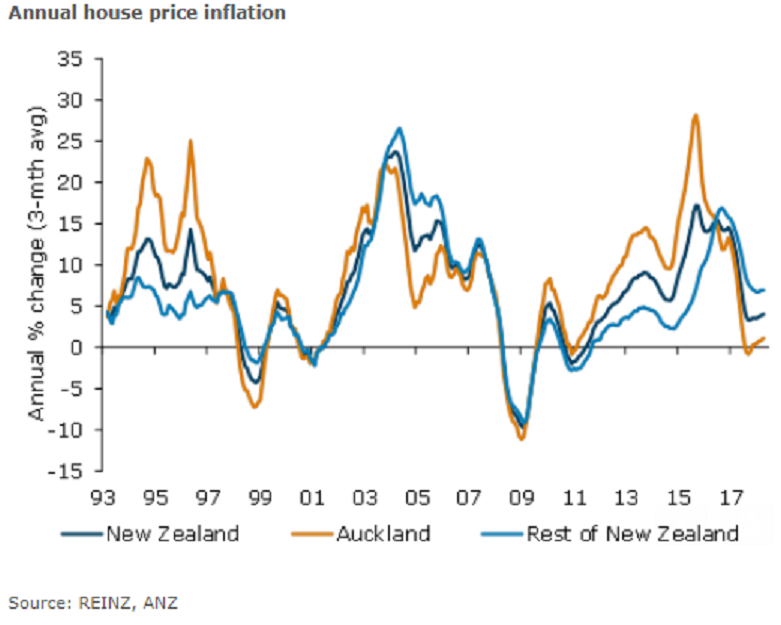

New Zealand’s REINZ data for April continue to point to a broadly stable housing market. National sales volumes were pretty flat both month-on-month and versus a year ago. House prices barely moved versus March (sa). Annual house price inflation is running at 3.9 percent y/y (3-month m.a.), supported by regional prices (6.9 percent ex-Auckland).

Sales rose 0.2 percent in April (seasonally adjusted), failing to bounce back from a 3.8 percent fall the previous month. Nationwide housing market activity is broadly stable, at 0.6 percent y/y (3-month m.a.).

The time to sell a property was unchanged at 37 days (sa) nationwide. This is below the historical average in every region except Auckland, pointing to some continuing tightness in regional markets.

National house prices are stable. Our preferred measure of house prices – the REINZ House Price Index (HPI) – fell 0.1 percent m/m in April (sa) and is up 3.9 percent y/y (3-month m.a.), unchanged from March.

"We expect house price inflation will continue to moderate at the national level. The market is unlikely to take off due to affordability constraints, credit headwinds and new Government policies. Regional divergence is likely to continue, unwinding some of the Auckland outperformance seen over much of the cycle," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed