Today June NFP report is to be published at 12:30 GMT from the United States.

What is the NFP report?

- NFP or non-farm payroll report is the monthly statistics on labor condition in the US released by the US Department of Labor Statistics. The report comprises goods, construction, and manufacturing sector companies.

- This report influences the financial markets deeply across asset class.

Key highlights –

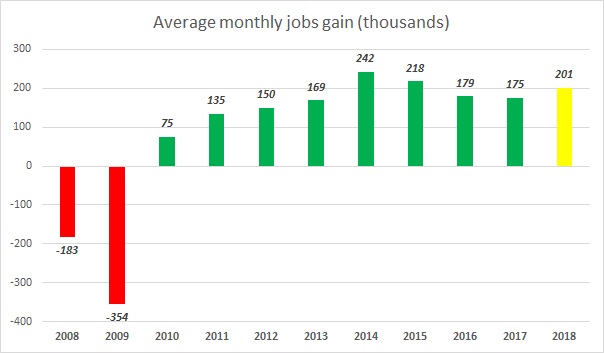

- The headline number for total hires last month was 201,000. June ADP employment number has been encouraging at 177,000.

- Today payrolls are expected at 195,000.

- The second most vital component is wage growth which as of now is showing a healthy growth of 2.7 percent. Today expected at 2.8 percent y/y.

- The labor force participation rate is showing no signs of rebound.

- The unemployment rate is expected to remain the same at 3.8 percent.

- The underemployment rate is expected to improve further from current 7.6 percent.

- Average weekly hours were previous 34.5; no changes expected today.

Impact –

- The immediate impact is usually very volatile and likely to affect the majority of the asset classes.

- A better than expected report especially the headline number (above 215,000) and wage growth could lead to further gains in the dollar which has been showing some weakness lately.

- The dollar could suffer setback along with U.S. equities on a materially weak report of headline below 150,000. The dollar index is currently trading at 94.33, down 0.07 percent so far today.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal