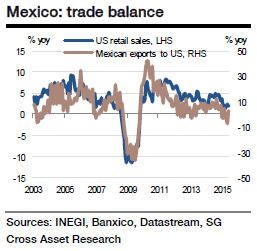

The trade balance year-to-date through August has worsened to -USD9.1b from -USD2.5b during the same period last year. The worsening trade balance primarily has to do with the fall in dollar exports growth while imports growth has also slowed down. This trend likely continued in September.

A trade balance at -USD521m is anticipated as exports likely contracted -5.4% yoy while imports likely fell by -2.5% yoy, estimates Societe Generale. The figures above aside, the growth of real exports has been quite impressive this year and is bound to show gains provided US growth strengthens. The shrinking dollar trade numbers in recent months just illustrates the significant depreciation of the peso this year.

In 2014, exports grew by 4.6%, while imports were up 4.9%. The current account balance improved slightly to -2.1% from -2.4% of GDP in 2013. However, it remains significantly below the much healthier -1.3% seen in 2012.

In general, stronger manufacturing export growth in H2 2015 and 2016 should help keep the current account balance unchanged, although lower oil prices could also keep it from improving. Falling oil prices have hit both the external account and Mexico's public finances. As a result, the current account balance deteriorated by between 0.5% and 0.8% of GDP on a structural basis, and it would take considerable improvement in manufacturing exports or penetration of new markets to see the current account return to its former size.

Mexico's trade deficit continues to rise on falling dollar exports

Monday, October 26, 2015 5:34 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX