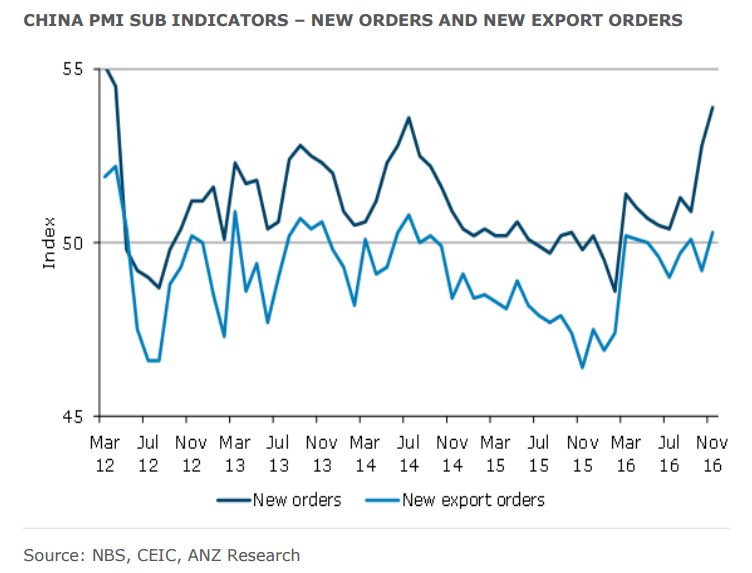

China’s manufacturing PMI spiked to 51.7 in November, up from 51.2 in the prior month and beating market expectations of 51.0. China’s manufacturing was the highest since July 2014. Rising steel prices which pushed steel industry PMI rose from 50.7 to 51.0 and increase in coal output following a price surge are likely to have contributed to the overall PMI.

China’s industrial profits also picked up in recent months, suggesting that China's overall growth profile has improved somewhat. Upbeat PMI figures also hint that the inflation expectations are on the rise, pointing to upside bias in market interest rates. The continued improvement in China’s PMI along with rising inflation expectations has reinforced the view that the PBoC may refrain from further easing for now.

That said, analysts have warned the recent uptick in the economy may be short-lived and that the recovery appears to be driven more by monetary easing that reforms. Indeed, Huang Yiping, PBOC member and Peking University professor, told the official China Securities Journal that the fourth quarter of the year and early next year could bring fresh downward pressure on growth.

PBOC Governor Zhou Xiaochuan has increasingly relied on market rates to guide policy, shifting away from the old benchmarks -- the one-year lending rate and the required reserve ratio for banks. Indeed, the one-year interest rate swaps (IRS) has surged to 3.2 percent this week, the highest since early 2015. This suggests that the market is pricing out further monetary easing for the time being.

"Today’s PMI supports our GDP forecast of 6.7% in Q4. With such a growth momentum, the PBOC does not need to ease. Their monetary policy stance will be neutral and they merely need to prevent the money market from liquidity stress," said ANZ in a report to clients.

The PBoC set yuan mid-point at 6.8865/dollar on Thursday vs the last close of 6.8980. USD/CNY made intraday high at 6.8960 and low at 6.8810 and was trading at 6.8879 at the time of writing. FxWirePro's USD Hourly Strength index at around 1200 GMT was at -28.1748 (Neutral bias). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist