The ECB has unleashed an unprecedented series of policy measures to try and push eurozone inflation back up to levels conducive to healthy economic growth. But even the most optimistic forecasts suggest that it could well be quite some time before inflation in the euro area returns to near target levels. Rout in oil prices constitutes a significant downside risk to the ECB's inflation expectations and is likely to refuel talks of further monetary accommodation from the central bank.

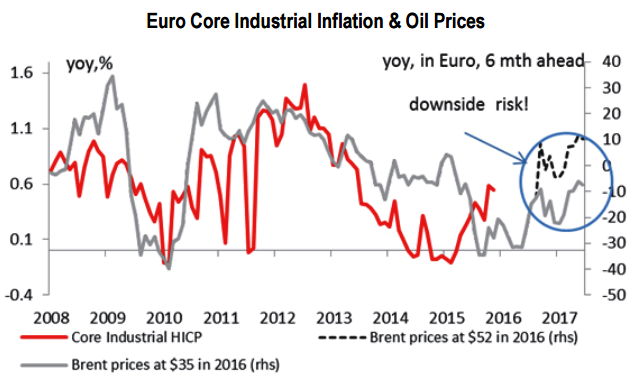

In early December, the ECB cut its deposit rate by 0.1% to -0.3% and revised down its inflation forecasts for 2017 by 0.1%, both on headline and core to respectively 1.6% and 1.5%. However, the forecasts were made under the assumption that Brent prices will average $52.2 and $57.5, respectively, for 2016 and 2017. The ECB assumed favourable base effects in energy prices will likely help push up inflation by 1.3% between November 2015 and October 2016, which is unlikely to be met! With forecasts for oil at $35, base effect linked to energy prices for 2016 could be roughly half the ECB's expectations.

Also, there is a growing sensitivity between short term inflation trends and medium term inflation expectations which the ECB called the risk of "un-anchoring inflation expectations". In financial markets, this has been visible through a rising correlation between oil prices and 5Y in 5Y inflation swaps. Indeed, in recent months there has been a rising inverted correlation between 5y in 5y inflation swaps and the EUR/ USD. A weaker exchange rate is seen as the key to limit this risk.

There's not much the ECB can do to control the oil prices. Crude oil slid to its lowest levels since 2004 on Monday. There is some pass-through from lower oil prices into EZ core inflation, which would, in particular, mainly impact core industrial goods in the months ahead. So, the lower the oil price, the lower the EUR/USD needs to be! This adds to pressure on the ECB to further "recalibrate" its monetary policy in 2016.

"While Eurozone inflation would still pick up in the coming two months, it will only reach a high point at around 0.6% y/y in January. Beyond this, inflation would once again move down before reaccelerating only in H2. So, all in all, Eurozone y/y inflation next year could be more around 0.5%/0.6% vs. 1.0% expected by the ECB and with a high risk in the first half of the year to see it once again cruising around the 0.0% y/y line", says Scotiabank in a research note.

Oil prices rose around one percent on Tuesday, bouncing off Monday's 11-year lows as investors closed bearish positions ahead of the year-end holiday but the global oversupply picture capped gains. EUR/USD was trading at 1.0927 as of 1115 GMT, while Brent futures traded up 29 cents $36.64 a barrel at 0917 GMT, recovering from an 11-year low of $36.04 hit on Monday.

Lower oil prices may add pressure on ECB to “recalibrate” monetary policy in 2016

Tuesday, December 22, 2015 11:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says