CFTC commitment of traders report was released on Friday (8th July) and cover positions up to Tuesday (July 5th). COT report is not a complete presenter of entire market positions, however, it represents a good chunk of institutional traders, to have a feel of what expected by the big players.

Kindly note, in some cases, numbers are rounded to nearest decimal.

- Gold – Net position long and increasing

Gold is proving to be investors’ darling. Since the beginning of June, net long position in gold has increased by more than 100 thousand contracts. And in last week, net long position got increased by 14,043 contracts to +316K contracts.

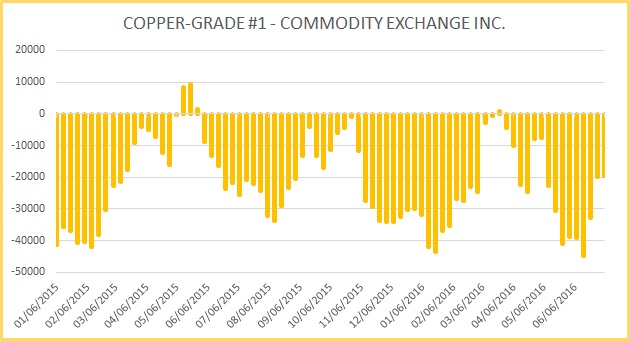

- Copper – Net position short and decreasing

Copper net short position saw only marginal decrease. Net short position decreased by 345 contracts to -19.5K contracts.

- Silver – Net position long and increasing

The net-long position in silver rose by 2,093 contracts to +85.7K contracts.

- WTI Crude – Net position long and decreasing

Crude oil saw a sizable decrease in net long positions by 4,567 contracts to +299.7K contracts.

- Natural gas – Net position short and decreasing

Natural gas registered another but small reduction in net short position by 2,515 contracts to -135.3K contracts.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022