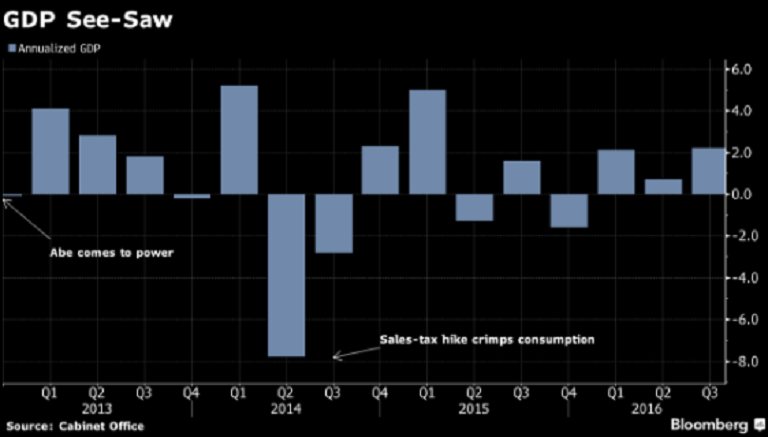

The economic growth of Japan during the third quarter of this year unexpectedly rose, largely beating expectations, following strong recovery in the country’s outbound shipments. However, weak consumer and household spending continued to exert downward pressure on the country’s near-term growth prospects.

Japan’s gross domestic product (GDP) expanded by an annualized 2.2 percent, data released by the Cabinet Office showed Monday, compared to a median estimate of economists for +0.8 percent. Exports grew 2.0 percent, the fastest gain in a year, but the increase was driven by potentially one-off factors such as a boost in shipments of smartphone parts.

Also, private consumption rose 0.1 percent, against consensus for a flat reading, while business spending remained unchanged during the period. Capital expenditure, a key component of GDP, remained flat, following a 0.1 percent decline in the second quarter, with worries about the global outlook and renewed yen gains weighing on business investment.

"Japan’s economy will continue to recover in the fourth quarter thanks to improving external demand lifting exports, but "domestic demand, such as private consumption and capital spending, isn’t that strong," Bloomberg reported, citing Yoshiki Shinke, Economist, Dai-ichi Life Research Institute in Tokyo.

In contrast, private inventories subtracted 0.1 percentage point from GDP in the third quarter, while government consumption rose 0.4 percent from the previous quarter, adding 0.1 percentage point to quarterly growth.

At 4:50GMT, the USD/JPY currency pair was trading 0.67 percent higher at 107.40, compared to previous close of 106.68, while at 4:00GMT, the FxWirePro's Hourly Yen Strength Index stood neutral at -58.5457 (lower than the benchmark of -75 for bearish trend).

Meanwhile at 4:55GMT, Japan's benchmark stock index, Nikkei 225 was trading 1.81 percent higher at 17,688.50 on the Tokyo Stock Exchange.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy