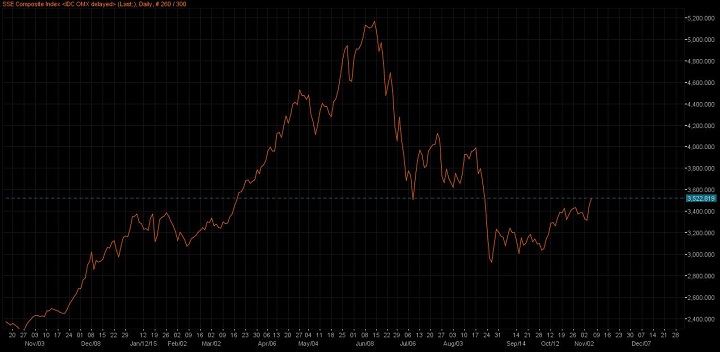

With recent stabilization in economic dockets from China, which has stopped deteriorating and appreciation in Chinese exchange rate, question naturally comes - weather the worst is over for China and its stock markets. Latest October PMI report suggests Chinese manufacturing sector is still contracting but at relatively lesser pace, while services sector growth actually picked up.

China's stock market is up for second consecutive day and up 20% from low made in August, which technically suggests that benchmark Shanghai composite is in bull market.

Sentiment has definitely turned the corner for China after turmoil in August. Forex data shows, capital outflow and drop in forex reserve that hit record in more than decade is stabilizing. Moreover, recent signal by IMF that it might choose Chinese Yuan to include in its SDR basket at November review.

For the stock market, mood has really turned in October, when stocks rose by 10.8%, ending its four month of consecutive loss. October has been stocks' best month since April, this year.

However, all this euphoria may be premature, given some indicators such as China's heavy industry, mining is slowing down still at rapid pace. Though risks of a hard landing may have diminished in the near term it is still too early to predict major economic recovery in China and to suggest falling growth has hit bottom.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand