In previous part released yesterday, we asked if the crash is over sighting technical sign that Chinese benchmark stock index is up 20% from August low, which is an indicator for bull market but pointed out that Chinese recent stabilization is good but too early to call for a turn around.

In this part, we discuss further from regulatory side and Chinese IPO.

- Chinese securities regulator have started approving IPOs after putting it off since summer, when Chinese stock market was plummeting at rapid pace. During the crash Chinese policymakers took several actions from banning IPOs and short selling, suspend trading, six months ban on share selling by large shareholders to direct intervention.

- All that effort seems to be bearing some fruits. After months of turmoil, and IPO ban since July, regulators are approving them again.

It is still too early from economic point of view to say that Chinese economy has turned the corner, given continued industrial slowdown.

Nevertheless, if the calm persists and economy turns corner, we are on the verge of a big bull run not only in China but around the world.

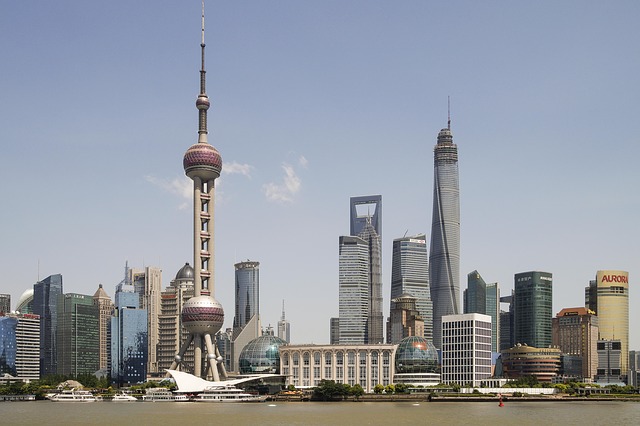

China's benchmark stock index, Shanghai composite is currently trading at 3590, up 1.9% for the day.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?