Beijing has rolled out a flurry of stimulus measures since last year as a part of attempts to avoid a hard landing. Interest rates were slashed six times since November 2014 and RRR was lowered four times this year. Beijing has also boosted spending on infrastructure and eased curbs on the ailing property sector.

China's official manufacturing purchasing managers index remained unchanged at 49.8 in October from a month ago, The October PMI missed the median 50.0 forecast. This is its third consecutive month below the 50 mark, amid signs that government spending has yet to make significant traction in the world's second-largest economy. Data showed that things have stabilized a bit, but the bad news is that there's been no pickup.

A raft of economic data due in the coming weeks (Oct trade data due Nov 8; Inflation data due Nov 10; Retail sales, other data Nov 11; Credit, money supply due Nov 10-15), could show tentative signs of stabilisation in the world's second-largest economy. Data is expecetd to be mixed, numbers are likely to show real economic activity remained sluggish, necessitating further policy support.

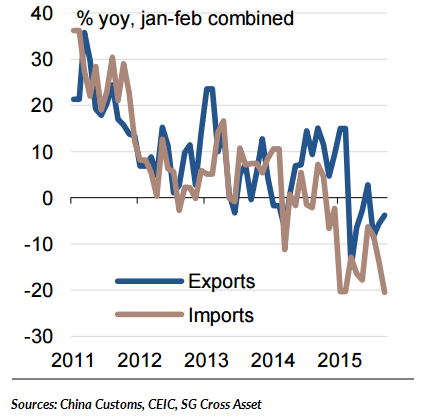

Annual consumer inflation likely inched down to 1.5 percent in October from September's 1.6 percent. Factory output likely grew 5.8 percent y/y in October, quickening from Sept's 5.7 percent rise while retail sales likely grew 10.9 percent. In a sign of subdued domestic and external demand, exports in October likely fell 3.0 percent y/y, while imports were seen falling 16 percent.

A survey by Reuters showed banks are likely to have extended 798.2 billion yuan ($125.98 billion) in new loans last month, cooling from September's 1.05 trillion yuan, while annual growth of M2 money supply may have risen to 13.2 percent, little moved from 13.1 percent in September.

"Improved loan demand in China in September and a jump in the number of investment projects had spurred hope that the economy was bottoming out, but the latest data is likely to disappoint investors. October data is not going to be as good as we thought." said Oliver Barron, China research head with investment bank North Square Blue Oak.

Chinese President Xi Jinping said on Tuesday that China can maintain annual economic growth of at least 6.5 percent over the next five years. But the government has admitted publicly that it has yet to find a "new growth engine" to replace dependence on investment intensive manufacturing and exports.

Upcoming Chinese data likely to disappoint investors

Thursday, November 5, 2015 11:24 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand