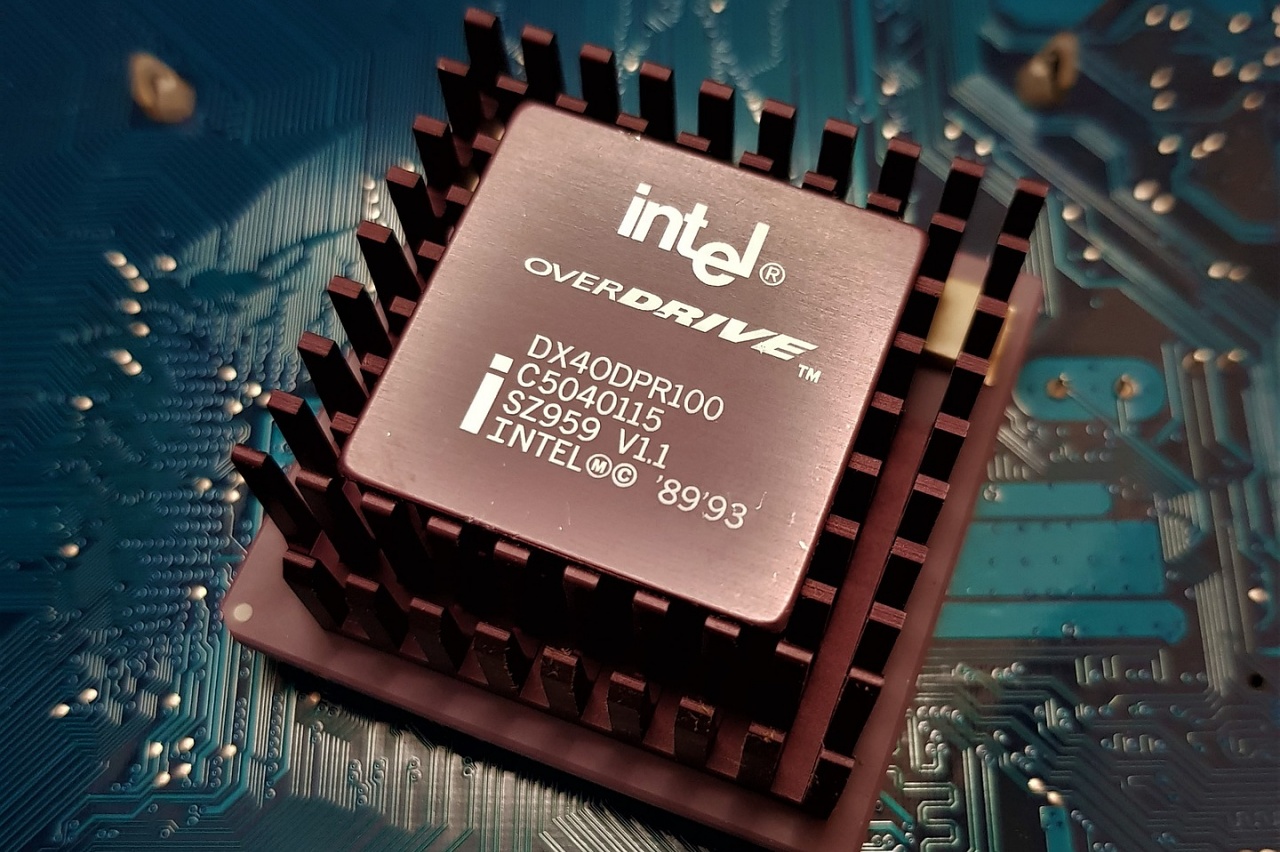

Intel Corporation has called off its planned $5.4 billion acquisition of Israeli chipmaker Tower Semiconductor after failing to secure pivotal regulatory approval from China. This setback forces Intel to pay a $353 million termination fee and reevaluates its strategies against dominant rival Taiwan Semiconductor Manufacturing Co. The decision poses a significant challenge to CEO Pat Gelsinger’s growth blueprint.

This means that Intel Corporation already terminated its deal for the takeover of Tower Semiconductor. The American tech company based in Santa Clara, California, explained that it had dropped the proposed deal “due to the inability to obtain in a timely manner the regulatory approvals required under the merger agreement.”

According to CNBC, with the cancellation of the agreement, Intel will have to pay Tower a hefty $353 million as a termination fee. In February last year, the company revealed its intention to buy the Israeli chip manufacturing firm.

At any rate, it was reported that Intel could not secure the approval of the Chinese regulator for the deal. This is an important part of the acquisition process, but the deadline has passed without issuing the needed consent. As they hit this snag, Intel and Tower Semiconductor agreed to terminate their agreement.

“After careful consideration and thorough discussions and having received no indications regarding certain required regulatory approval, both parties have agreed to terminate their merger agreement having passed the August 15, 2023, outside date,” the Israeli chip company said in a statement.

Finally, Bloomberg reported that the failed buyout plan of Tower Semiconductor was considered the foundation of Pat Gelsinger’s, Intel’s chief executive officer, plan to penetrate the faster-growing part of the chip industry and foundry market, which is currently being dominated by Taiwan Semiconductor Manufacturing Co. (TSMC). Thus, the development was kind of a blow to Intel.

Photo by: Michael Dahlenburg/Pixabay

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO

Kroger Set to Name Former Walmart Executive Greg Foran as Next CEO  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised