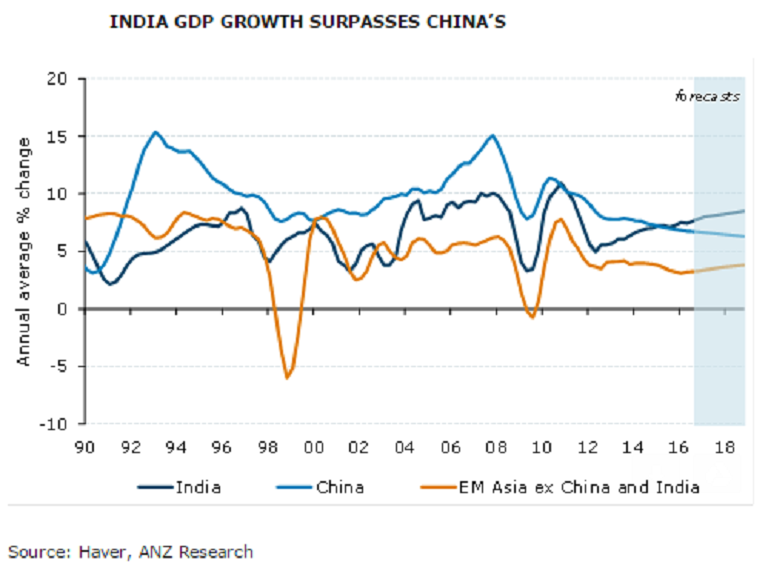

The Indian economy has been growing at a premium to other emerging Asian economies during the recent years, largely owing to a mix of structural as well as cyclical tailwinds. This has resulted in the economy remaining more and more resilient to the ongoing global headwinds, concerning a wide range of economic as well as political events.

An environment of robust domestic macroeconomic fundamentals amid reduced external vulnerability, the center stage is prepared for the country to grow at a forecasted rate of 8.0 percent during the fiscal year 2017 and 8.2 percent during FY2018; easily, reckoning the fastest growing economy in Asia, ANZ reported.

From a structural point of view, India continues to be the torchbearer in the field of 'ease of doing business', establishing a significant ranking in global competitiveness. However, the vulnerable banking sector has remained a major hurdle to an otherwise strong economy, contributing to the weak private investment climate.

Given a better external position, commitment to keep inflation in check, and strong growth prospects, the Indian rupee is expected to be less vulnerable to external shocks. However, the INR real effective exchange rate is elevated, so further appreciation looks limited. But with the RBI having the best FX reserve adequacy in the region, there is scope to prevent excessive volatility in the INR, the report added.

Meanwhile, it is imperative to sustain the ongoing pace of reforms, especially till the ruling party’s term ends in 2019. However, markets may react adversely to the upcoming state elections scheduled to be held next year, which could disturb the country’s growing spree.

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk