The ECB's exposure to Greece is not huge and ultimately lies with the euro-zone governments that would have to recapitalise it. But a Greek default to the ECB would be a serious blow to the Bank's credibility that could limit its ability to control inflation or support stressed bond markets in future.

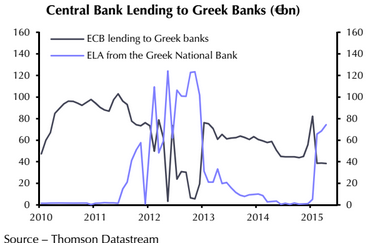

The ECB is exposed to a Greek default through two direct channels. Its holdings of Greek government bonds purchased during the Securities Markets Programme (SMP) have a book value of €18bn, or 0.2% of euro-zone GDP. Chart shows that €6.7bn worth matures this summer. And its lending to Greek banks through refinancing operations was €38.5bn (0.4% of GDP) in April. So in the event of a sovereign default and associated collapse of the banking sector, the ECB could suffer losses of up to €56.5bn, wiping out its subscribed capital of €10.8bn, but not its total capital and reserves of €96bn, notes Capital Economics.

How vulnerable is the ECB to a Greek default?

Thursday, May 28, 2015 9:01 AM UTC

Editor's Picks

- Market Data

Most Popular

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell