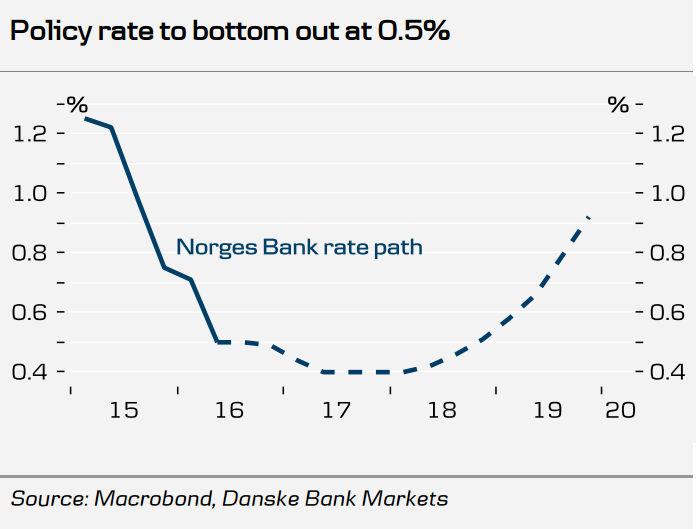

Norges Bank earlier this week left the key policy rate unchanged and revised higher the interest rate path in line with market expectations. Rate path was raised by 24bps in Q4 2016 and 12-19 bps in 2017-19. The rate path now indicates about 20 percent probability for 25bp cut by 15 Dec 2016 and another 20 percent in March 2017. Rates were gradually forecast increasing to 0.92 percent by end 2019.

Key economic indicators have signaled that the worst may be over for Norway’s economy, which bore the brunt of a slump in oil prices earlier. Unemployment has risen to 5 percent, the highest in about two decades, but the pace of rise in registered unemployed has been slowing and house prices are surging. The bank predicts that unemployment will head lower, reaching about 4.7 percent next year and 4.4 percent in 2018.

“The central bank has handled the downturn relatively well. It has gradually cut rates and along with falling oil prices contributed to keeping the krone low, which has been an important factor in reviving the economy,” said Erik Bruce, a senior economist at Nordea in Oslo.

Oil markets are seeing signs of recovery as OPEC officials are meeting in Vienna this week, in order to work out the shape of a possible output deal. Norway's oil investment is still falling and having negative effects on parts of the manufacturing sector, but the headwinds clearly seem to be easing.

It seems that growth outside the oil sector is accelerating. Norges Bank predicts mainland gross domestic product excluding oil and gas will expand 1.8 percent next year and 2.1 percent in 2018, after 0.9 percent growth in 2015. It predicts the plunge in petroleum investments will come to an end in 2018. The central bank has successfully managed to the krone lower which has helped steer the economy out of trouble.

Inflation has risen much further than expected over the past three months. But is expected to slow gradually as the effects of the krone’s depreciation fade, and along with a stronger labour market this will provide more support for private consumption.

"Norges Bank will now keep rates unchanged at 0.5% throughout 2017. As we see it, only a significant strengthening of the NOK could trigger a further rate cut." said Danske Bank in a report.

EUR/NOK slumped over 1.65 percent after the Norges Bank policy decision to lows of 9.0877 on Thursday. The pair was consolidating downside on the day, trading 0.11 percent lower at 9.1030 at around 12:00 GMT. Technical indicators indicate downside. Strong support seen at 9.088 levels. Break below could see a drag upto 8.9566.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand