- The yellow metal edged higher and made high of $1239 yesterday.

- Gold was benefited from the lower US markets, DJIA closed down -40.4 pts or -0.25% and S&P 500 closed down -8.99 pts, -0.47%.

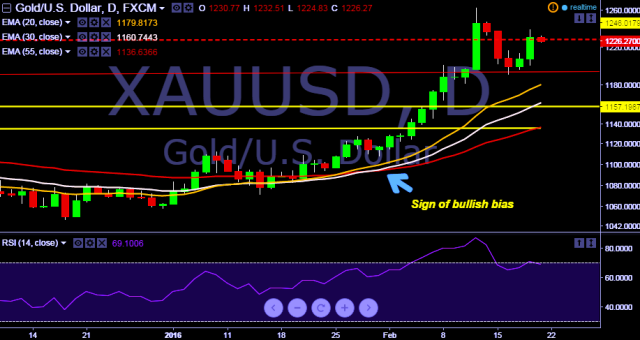

- Today pair made intraday high at $1232 and low at $1224 levels.

- Intraday bias remains bullish till the time pair holds key support level at $1195 marks.

- On the top side, a daily close above $1239 will drag the parity towards $1268, 1292 and $1300 thereafter.

- Alternatively, key support levels are seen at $1222, $1218 and $1208 thereafter.

- Later today, US will publish inflation data. Analysts are projecting the consumer price index to fall 0.1% in January, on top of a similar-sized decline in December.

We prefer to take long position in XAU/USD around $1223, stop loss $1218 and target $1252 levels.

FxWirePro: AUD/USD jumps after RBA rate hike

FxWirePro: AUD/USD jumps after RBA rate hike  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  GBPJPY Roars Back 100 Pips — Bulls in Charge Above 210

GBPJPY Roars Back 100 Pips — Bulls in Charge Above 210  FxWirePro: GBP/NZD remains weak, eyes 2.2550 level

FxWirePro: GBP/NZD remains weak, eyes 2.2550 level  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar

FxWirePro: EUR/AUD bearish as RBA hike boosts Australian dollar  FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside  Major European Indices

Major European Indices  NZDJPY Breaks 94: Bulls Charge as Kiwi Roars Back

NZDJPY Breaks 94: Bulls Charge as Kiwi Roars Back  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: USD/CAD extends gains, eyes 1.3800 level

FxWirePro: USD/CAD extends gains, eyes 1.3800 level  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls

AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  USD/CHF Breaks Out: Bullish Surge Past 0.7800 Fuels Fresh Upside Momentum

USD/CHF Breaks Out: Bullish Surge Past 0.7800 Fuels Fresh Upside Momentum