Market seem to be expecting a big bazooka from European Central Bank (ECB), when the governing council will meet on December 3rd to decide further move in monetary policies. It is broadly expected that ECB will use combination of monetary policies, one that would include reduction of deposit rates by at least 10 basis points along with increase in the asset purchasing period from current end of September 2016 and rate of purchase from current € 60 billion per month.

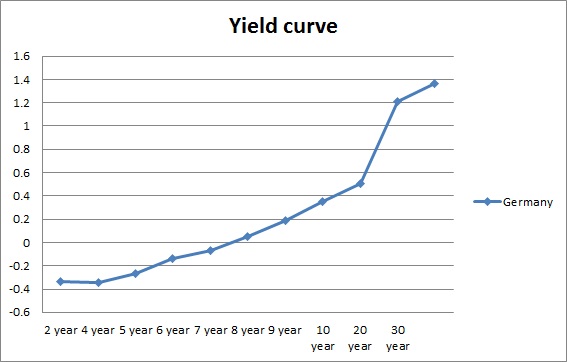

German government has sold 2 year yield at record low and further in negative, at -0.38%, which means investors are paying to lend money to Germany. An incident like this without ECB's negative deposit rates or asset purchase would indicate massive risk aversion or heavy deflation or combination of both.

German yield curve is now negative up to six years and debt up to four years are well below the current deposit rates making them not eligible for purchase by Bundesbank, which is supposed to buy almost € 10 billion worth of bonds every month.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?