Gold prices held steady at three-week highs on Friday, as the Bank of Japan’s stimulus measures disappointed market expectations and as the Federal Reserve’s decision to leave its monetary policy unchanged continued to support.

On the Comex division of the NYME, gold futures for December delivery were little changed at $1,341.75.

The strong gold rally during the first four months of this year was driven largely by speculative buying and ETF investment. However, its level looks increasingly unsustainable; not least as key physical markets in India and China have seen demand plummet and scrap supply surge.

As a result, we believe that it will prove increasingly hard for western investors to sustain the rally, and when ETF flows dry up and the Fed raises interest rates, this could prove the turning point for gold. In India, domestic gold prices have been trading at a discount for the longest period since 1980.

Import volumes in the first four months to India were less than half the same period last year.

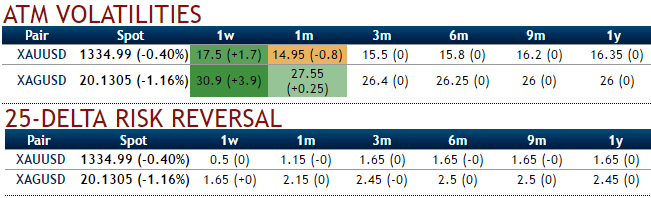

1w ATM IVs are at 17.5% with bullish risks signalled by the risks reversal numbers.

Hence, we recommend the covered straddle which is a bullish option strategy that involves the simultaneous selling of equal number of puts and calls of the same underlying spot gold, exercise price and tenor while owning the underlying spot gold. Please be noted that only the call options are covered.

Also, be informed that the maximum return for the covered straddle is reached when the underlying gold price on expiration date is trading at or above the strike price of the options sold.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary