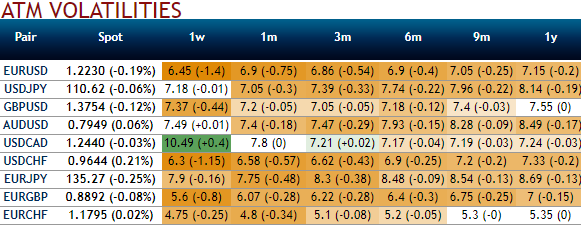

Please have a glance in above nutshell evidencing ATM IVs, no pair is having implied volatilities above 8.5% except 1w USDCAD contracts. Amid this depressed vols circumstances, we find that yen crosses have strong potential for successful double no-touch (DNT) trades in 2018 as JPY softness carried through this year.

JPY underperformance was a highlight as well as USD softness. USDJPY consequently remained in a roughly three yen range while JPY nominal effective exchange rate marked the lowest level since February 2016 on January 5 this year though it has rebounded this week. Meanwhile, JPY crosses extended the upside; EURJPY reached 136-handle for the first time in more than two years.

In a context of depressed volatility, range-bound currencies, and persistently low yields, DNT options are an appealing alternative to the underperforming carry trade.

A DNT sells volatility to deliver potentially substantial leverage. Unlike standard carry strategies, investors risk only a fixed premium, but they gain theta as long as two knockout levels are not hit.

Low volatility and DNT trading lead to a paradox: one looks to sell expensive volatility, but high volatility increases the risk of seeing a DNT knocked out. We propose and combine four intuitive indicators to identify the currency pairs offering the most attractive trade-off.

In a context of low yields, depressed volatility and range-bound markets (refer above technical chart), double no touch (DNT) options provide an appealing alternative to the FX carry trade.

The current global macro environment is characterized by weak economic volatility. One of the consequences is that FX volatility has been depressed during most of 2H'17. Sustained growth but still-soft inflation dynamics are ensuring that monetary policy normalization is a slow process so far, with limited risk of acceleration by central banks.

Frustratingly, the low FX volatility isn’t supporting carry trades given the depressed yields. The G10 carry trade has suffered throughout 2017, and after a strong start, EM carry is also biting the dust (refer above graph). Also, currencies are not exhibiting strong trends that could favor momentum trading. In this context, investors are still struggling to generate returns.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics