It’s been a great beginning for the crude prices in 2018, with Brent crude futures about to touch $70/bbl, their highest level since Dec 2014. Brent is up by 14.5%since the OPEC-NOPEC meeting on 30 November 2017and was up by 18% in 2017. We reckon that the driving forces have been tighter fundamentals, but geopolitical risk and currency moves, along with speculative money in tandem, have also exacerbated the move.

Tight oil market fundamentals are driven by strong demand on the back of freezing winter conditions materializing, synchronized global economic growth supported by the latest manufacturing numbers and supply outages from pipelines in the North Sea to Libya have led to tightness in the physical markets.

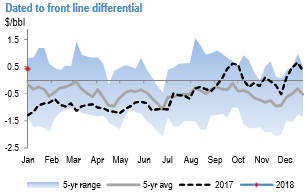

Markets were already well-supported thanks to the positive outcome of the OPECNOPEC meeting to not just extend existing production cuts into the whole of 2018 but also to cap Libyan and Nigerian production and thereby removing any uncertainty on incremental supply from the two OPEC players. Consequently, the spread of Dated Brent to don’t month futures remains in positive territory (refer above diagram).

Geopolitical risks are also on the rise and risks around Iran and Venezuela could play a key role in supporting oil prices in 2018. Money managers have increased their net longs for both Brent and WTI (futures only) to 950k lots, just shy of the record high noted at the end of Dec’17 at 960k lots, (refer above diagram). This, in addition to weakness in trade-weighted US dollar index, has been further supportive of oil prices and other commodities in general.

Oil demand has been boosted significantly in recent weeks by the extremely cold weather in North America. This seasonal fillip adds to robust economic activity that has lifted growth expectations for 2018 and beyond. Furthermore, the continued upside surprises in economic activity evident in the global economy run counter to the weakness seen in Chinese data (refinery runs and crude imports)for July and August, which hinted at slowing growth rates, (refer above diagram). Courtesy: JPM

Trade recommendation: Go long in NYMEX WTI vs ICE Brent spreads of Mar’18 delivery: The continued tightness in US oil markets with strong demand and stabilization in US crude supply should lead to further decline in Cushing stocks and be supportive of front-month WTI Brent spreads.

But this trade is tactical as we do realize that any uptick in rig activity will turn this trade around. That will be the trigger to exit the trade.

Go long Mar’18 NYMEX WTI vs ICE Brent spreads at -$5.81/bbl. Trade target of $4.8/bbl and stop loss of -$6.1/bbl.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand