Today, the ECB’s Bank Lending Survey will give us more insight into how the ECB’s monetary policy feeds through to the real economy. The current EUR strength will tighten the financial conditions further, and that might make the ECB nervous. Even though the ECB is clearly moving towards another reduction of its monthly bond purchases, it might avoid further hawkish signals at its meeting on Thursday so as to not put additional pressure on the EUR. After all, ECB policymakers were not happy about the significant appreciation of the EUR after ECB President Mario Draghi’s first hints that a (very cautious) exit from the expansionary monetary policy is on the cards.

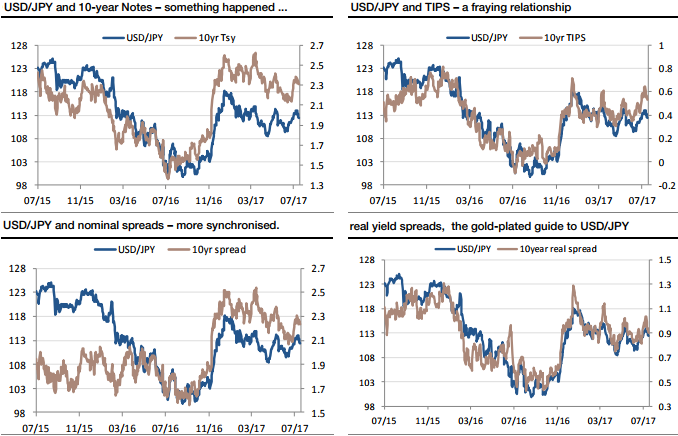

While USDJPY drifts are closely-correlated to 10Y real yield differentials, but as long as Bund yields are rising, we like being long EURJPY. On the basis of the relationships below, our best guess of what it takes to get USDJPY back to 120, is that it’s going to require real US yields to get close to 1%. The biggest threat to USDJPY bulls is that 10year real yields continue to climb in Japan – a risk highlighted by the prospect of the BOJ downgrading its inflation forecast at this week’s meeting.

The danger of inflation expectations seem to be falling, driving real yields higher and supporting the yen, is a good enough reason for the BOJ to maintain its current super accommodative stance. The story is a bit different in EURJPY because German and Japanese inflation expectations are more closely aligned.

That means that nominal yield differentials are more useful and since JGBs don’t move, higher Bund yields drive EURJPY higher which is handy since we expect these to reach 1% in due course.

The 1st four charts shown above emphasizes two years’ worth of rough and ready USDJPY correlations. Over the last year, the real yield differential has the closest correlation with USDJPY, though all four combinations perform well.

Society Generale reckons that the weakest correlation is between USDJPY and nominal yield spreads, which stems back to the BOJ’s botched move to cut rates below zero in early 2016, which triggered both yen buying and a sharp fall in inflation expectations. A repeat is possible if we see markets lose confidence in the BOJs ability to prevent a slide back into deflation. During the Trump era, US TIPS yields have been range-bound, but the calm has been punctuated by some sharp moves (refer above chart).

There is a base in TIPS yields at 30bp, and 4 spikes higher. JGBi yields, meanwhile, have been trending upwards as breakeven inflation rates have fallen back towards zero. The upshot is a series of lower peaks in the relative real yields (refer above chart). USDJPY bulls need higher nominal US yields, for sure, but they also need that series of lower highs in relative real yields to end.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic