The interest rates, commodity prices, and risk sentiment have favored the AUD over the NZD lately. Some of Australia’s key commodities are well up over the year. This week’s event calendar highlight is low key. Q1 construction work done will help guide estimates of Q1 GDP (out on 6 June). RBA governor Lowe speaks.

Bearish AUDNZD scenarios (likely to dip towards 1.0320-1.0190 levels):

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market;

2) China data weaken materially; or

3) The risk markets retrace and vol rises.

4) NZ Fiscal easing is delivered quickly;

5) Kiwis inflation expectations begin to ratchet up quickly ahead of the government’s minimum wage increases

Bullish AUDNZD scenarios (likely to rise to 1.1330-1.1420 levels):

1) China eases policy and commodities rebound;

2) The RBA adopts a more hawkish tone to its communications

3) The housing market in NZ slowdown becomes disorderly;

4) The NZ immigration rolls over quickly;

5) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

The AUDNZD month-old rally has stalled at 1.0940, although it does retain potential to break above that.

However, the medium-term perspectives are: The pair has made a medium-term bottom at 1.0488 in April, and should extend beyond 1.0900 which is the fair value according to interest rates and commodity prices. Around 1.1000 it may start to look technically stretched.

OTC outlook:

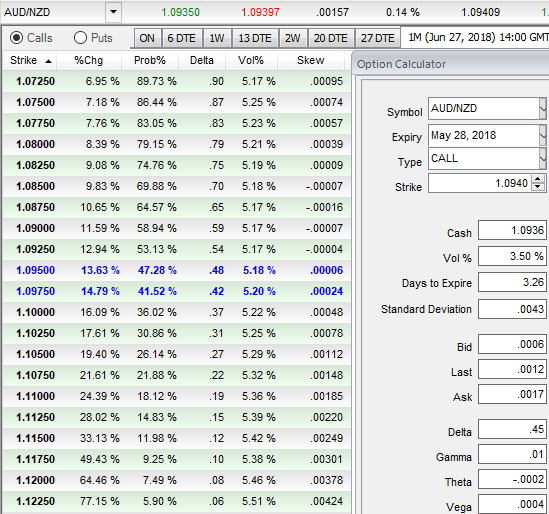

If you could observe sensitivity table of AUDNZD, the skews are stretched on either side but more potential on upside strikes.

Hence, in order to arrest upside risk that is lingering in both short-term trend and major declining trend, we recommend restructuring previously advocated options straps into the diagonal option strips strategy that favors underlying spot’s downside bias in the short-run and mitigates bearish risks in the medium-term.

Hence, we advocate building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta put option of 3m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bearish as well as bullish risks irrespective of spot moves. However, on speculative grounds, more potential is foreseen on the upside. Please note positive cashflows whether the underlying spot keeps flying or dipping.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 101 levels (which is bullish), while hourly NZD spot index was at shy above 139 (bullish) while articulating (at 10:12 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge