We’ve shown here some significant factors that determine the underlying spot FX price of USDJPY:

1) If the strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, and

2) If Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations,

Then, we could foresee bullish USDJPY scenario hitting to 125 levels on above fundamental driving forces.

Where USDJPY is projected to slide towards 100 if:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness, and

3) The expectations for more hawkish than expected personnel change of the BoJ heighten.

Options trades recommendations:

Buy GBPJPY – USDJPY 1Y ATM straddle spread, equal JPY vega.

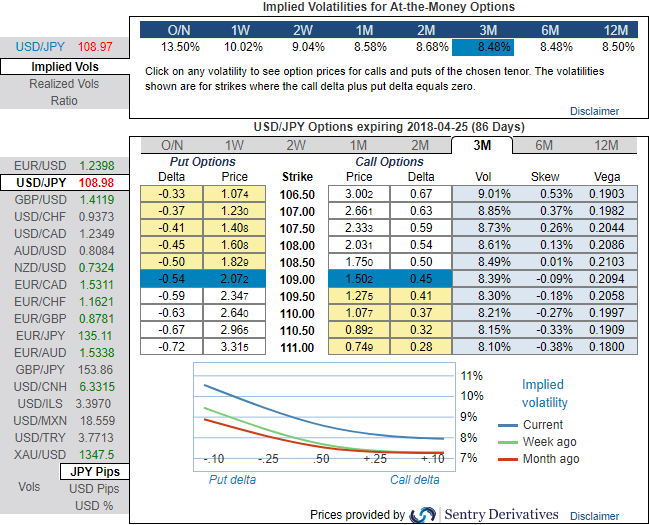

The implied volatility of ATM contracts of USDJPY is trading at around 8.48%-8.58% for 1-3m tenors, as the delta risk reversals flashing up progressively with positive sentiments in near terms that signify the shift in hedging sentiments for downside risks in near terms, this appears to be conducive for put option writers. Positively skewed IVs of 3m tenors are signaling bearish risks.

Thus, we advocate buying USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 109.029).

Currency Strength Index: FxWirePro's hourly USD spot index has shown -62 (which is bearish), while hourly JPY spot index was at 86 (bullish) while articulating at 07:43 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?