Demand for the crude oil is increasing healthy and increasing seasonally while crude production continues to decline.

Saudi Arabia’s Deputy Crown Prince Mohammed Bin Salman (MBS) said that Saudi Arabia could increase crude output to 11.5 Mb/d immediately and go to 12.5 Mb/d in 6-9 months "if we wanted to".

This has caused questions and concerns over whether the Saudis intend to flood the market with crude. While the Saudis have the capability to do this, based on a careful reading of MBS’s full comments in the story, we do not believe that is their intention.

That said, the upcoming typical seasonal increase in Saudi crude production may well keep these questions and concerns alive until after the summer is over.

Demand/Supply equation:

Demand - Ripping strong product demand is supporting margins and bolstering high crude runs. 4W average product demand was very robust, increasing by 770 kb/d to 20.0 Mb/d (+4.0% YoY). Margins are strong and runs are expected to climb seasonally.

Supply on weekly basis - US crude supply fell by 15 kb/d, entirely due to a drop in lower 48 production.

4W average US crude output is down by 413 kb/d (-4.4% YoY), while 4W average US crude imports are up by 89 kb/d (+1.2% YoY). US crude exports are actually down by 142 kb/d to 352 kb/d (-28.8% YoY).

Oil prices jumped on Monday as a huge wildfire in Canada's oil sand region knocked out over a million barrels in daily production capacity, contributing to a significant tightening of markets.

As a result, WTI futures jumped 93 cents or 2.08% to $45.59 per barrel by 09:05 GMT.

Crude for June delivery on the NYME tacked on 28 cents from previous flashes, to trade at $46.49a barrel by 13:22UTC, after rising by as much as 2.1% to a daily peak of $45.94.

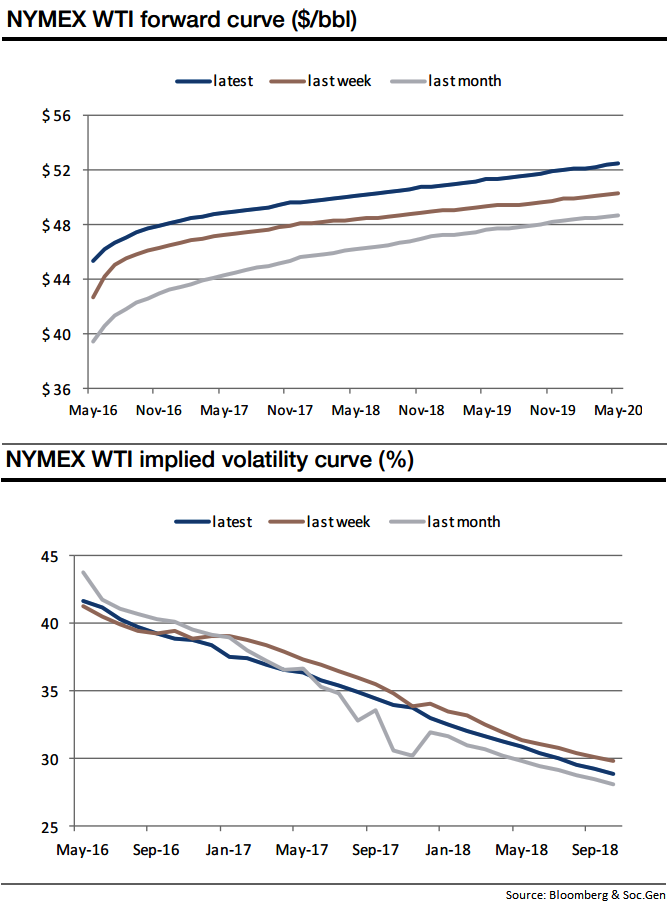

You can also observe NYMEX WTI forward rates are spiking higher above $45 a barrel, while implied volatilities are shrinking below 40% for May 2017, lower or reduced IV implies the market thinks the price will not move much.

You can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range.

The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive.

The IV information in charts can be utilized when deciding which options to buy or sell. It is significant to note you cannot match up to the IV values of different options.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary