VXY is entering H2 having declined an eye-watering 4 %pts from its 1Q highs, one of the largest half-yearly drops on record outside of the GFC.

H1’17 has not made vol buying great again. The French elections also circumvented a major banana skin by delivering an expected mainstream Presidency, while the surprising outcome of the UK general election had little ramifications for ex-GBP currencies; in short, no Brexit or Trump-like upheavals, hence unflattering vol returns.

As per the JPM Global PMI, FX vols have collapsed to their least levels since the Great Moderation of 2014. A simple econometric model of the VXY constructed with a global business cycle variable, a proxy for growth surprises (rolling 12-mo std. deviation of global PMI) and an uncertainty indicator (average inter-quartile dispersion of consensus forecasts for 4-qtr ahead real US GDP growth, 4Q ahead unemployment rate and 4Q ahead headline CPI provided by the Philadelphia Fed’s Survey of Professional Forecasters)shows that VXY that Global at 7.5 is 2.0 % pts too low versus fair value, amounting to a 1.3 std. error mismatch (refer above chart).

We have no quarrel with low-intensity jitters continuing through this month as the position shakes out in duration-heavy bond markets plays itself out; indeed, the recent FX price action is very much in line with our baseline 2H’17 view of a moderate turn higher in vol. At the same time, however, we are sceptical that the ongoing bond sell-off will morph into a more sinister trigger for risk markets; the V-shaped vol rebound from here if it did would be out of character with the typical U-shaped basing pattern around prior cyclical troughs in the VXY which typically only end with economic (recession) or geopolitical events.

That said, these are not placid markets and there are a couple of lessons to be gleaned from the pattern of recent vol returns that can prove useful for defensive option plays:

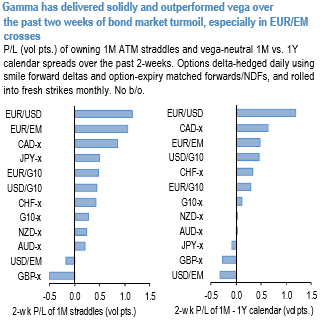

Gamma is performing solidly, and comfortably outpacing vega (refer above chart), which is to be expected when markets go into a pothole with ultra-low levels of front end vol and steeply upward sloping vol curves. Vol curve flattening was indeed one of our core views for H2, and the upbeat performance of vega-neutral, long gamma calendars supports our conviction in employing them as defensive vehicles.

The currency bloc breakdown of gamma returns in the above chart is revealing. EURUSD and EUR/EM are the best-performing currency pairs, while USD/EM, GBP, and AUD-crosses have been disappointing. In general, owning gamma in USD-pairs and EUR-crosses --the two currencies at the heart of the rate normalization dynamic - appears to be a decent rule of thumb.

The underperformance of USD/EM as a bloc is surprising, and illustrates the wide dispersion in EM FX behavior: while a few carry trade heavyweights such as TRY, ZAR and MXN printed sizeable spot ranges last week, others such as USD/Asia-ex KRW remained relatively well-contained.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics