Following the attempted coup and the wave of purges by the Erdogan government, the Turkish economy slipped into recession. But according to official data, GDP jumped in Q4 by a hefty 3.9% in the quarter.

Monthly data releases paint a different picture. Falling tourism revenue, a widening trade deficit, a surge in the unemployment rate – this is not consistent with the GDP release.

Yet, it seems we have to base our forecast on official data. We see GDP growing at a rate of 3.3% this year.

On the back of the lira weakness, inflation rose to 11.3% in March, and the core rate came in at 9.5%. The real interest rate is thus still around zero. Inflation pressure should remain high this year.

A softer dollar, falling bond yields in developed markets and funding costs that are kept at relatively high levels in Turkey have stabilized the lira. Should this continue the central bank will likely start to lower average funding costs gradually. This should exert pressure on the TRY.

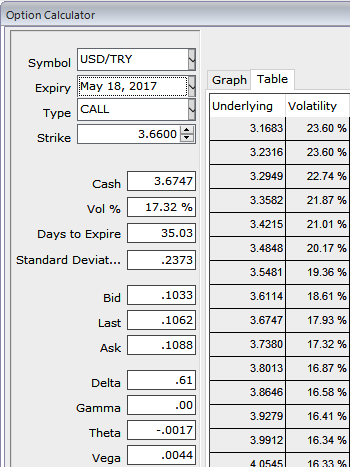

Hedging Framework:

At spot reference: 3.6750, capitalizing on prevailing dips of this pair one can load up shorts in ITM calls and longs in either ATM or OTM calls in a credit call spread with a narrowed strikes of similar expiries.

While the major uptrend could be arrested by the longs of the underlying pair with longer tenors as the 1m ATM IVs are spiking above 17.32%.

So it is advisable to initiate Credit Call Spread (DCCS) in order to tackle both short-term dips and major uptrend.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings