European central bank is lined up for monetary policy meeting this week, following the ECB’s surprisingly dovish message last week, signaling no hikes in 2019, we see significantly less upside for EURJPY this year, EURJPY could probably show slumps further in the intermediate-term amid the minor upswings in the short-term, and we see a possibility of the cross falling towards 122.

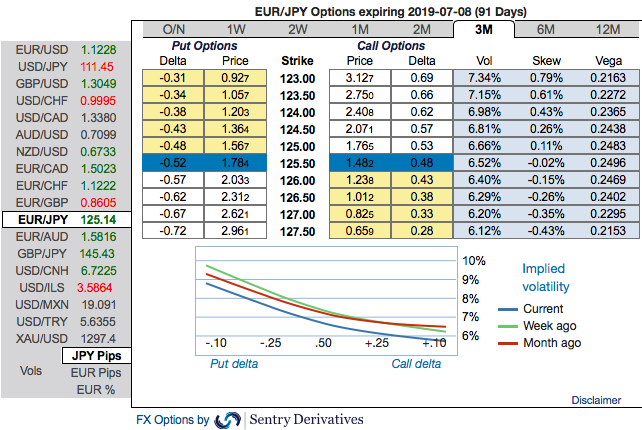

Risk reversals Substantiate Skews (EURJPY): We could see the existing bearish neutral risk reversal set-up of euro crosses (especially EURJPY and EURUSD) that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Hedging skewness (EURJPY): Most importantly, to substantiate the above indications, please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 121.00 levels so that OTM instruments would expire in-the-money.

Options Trade Recommendation (EURJPY): We’ve advocated buying 3m EURJPY (1%) ITM -0.69 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money put option with a very strong delta will move in tandem with the underlying. Source: Sentrix and Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 111 levels (which is bullish), while hourly JPY spot index was at -48 (bearish) while articulating at (11:22 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts