Intraday bias - Bullish

USDCAD showed a minor sell-off after the BOC monetary policy. It hit a low of 1.3622 and is currently trading around 1.36448.

Bank of Canada kept its rates unchanged as expected at 5%. The central bank reiterated that it will hike rates if inflation persists. The pair retested and showed a minor pullback after upbeat US ISM services PMI.

US ISM services PMI rose to 54.50 in August, compared to a forecast of 52.50. The US dollar index gained momentum after US ISM services hit the strongest level since Feb.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep decreased to 80.50% from 89% a week ago.

The US 10-year yield showed a minor sell-off on less hawkish comments from Fed chairman Powell. The US 10 and 2-year spread widened to -84% from -66%.

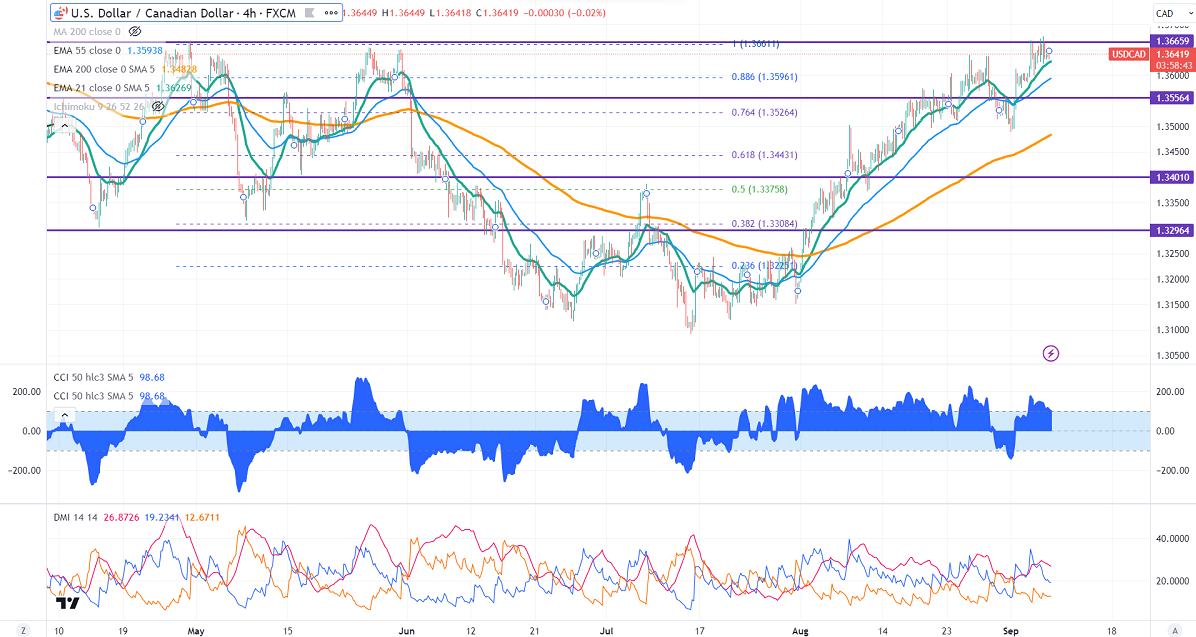

Technically in the 4-Hour chart, the pair is holding above the short-term( 21- EMA), 55 EMA, and above the long-term moving average of 1.34770 (200- EMA). Any violation above 1.3670 confirms further bullishness. A jump to 1.3700/1.3780 is possible. The near-term support is around 1.35800, and any breach below targets 1.3535/1.3480.

WTI crude oil rose more than $2 due to extended supply cuts from Russia and Saudi. Any break above $88 will push oil prices up to $90.

Indicators (4-Hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to buy on dips around 1.3580 with SL around 1.3535 for a TP of 1.3700.