Intraday bias - Bullish

USDCAD showed a minor sell–off despite weak Canadian GDP data. The economy got stagnated in the fourth quarter and came at 0%, well below the forecast of 1.5%. The monthly real GDP came at -0.1% compared to a forecast of 0%. This has decreased the chance of further rate hikes by the Bank of Canada. It hits a low of 1.35900 and is currently trading around 1.36050.

The conference board consumer confidence declined for a second consecutive month in Feb to 102.90 vs. the forecast of 108.50 US Richmond manufacturing index decreased to -16 in Feb, below the forecast of -5.

Major economic data today

US ISM manufacturing PMI

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Mar declined to 23.30% from 24% a week ago.

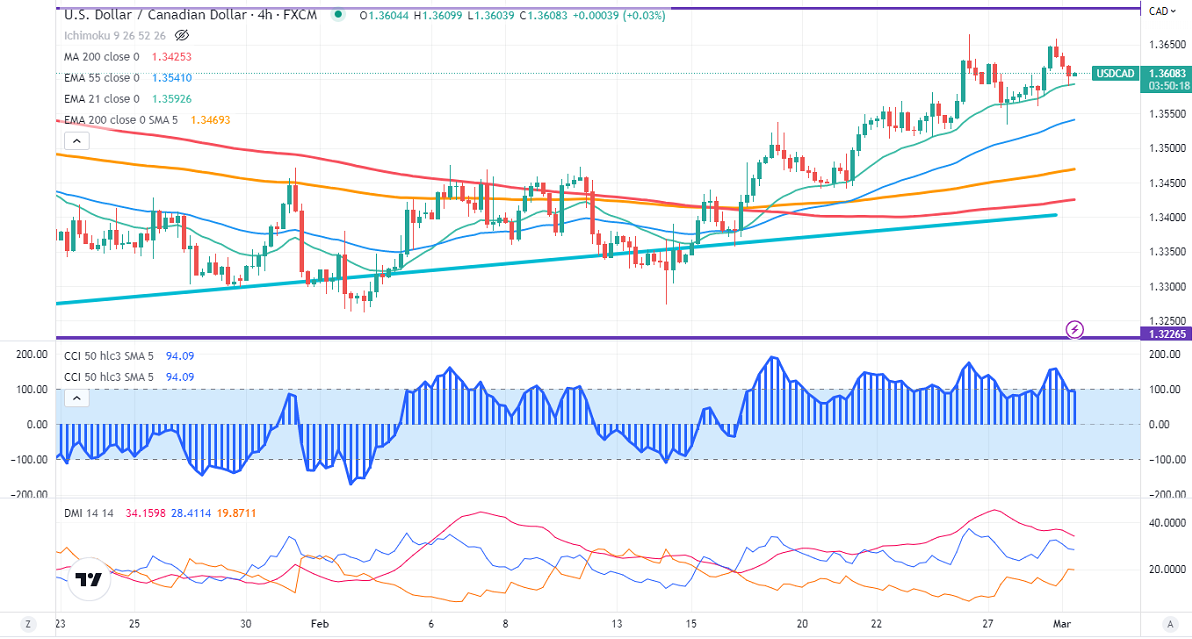

Technically in the 4-Hour chart, the pair is holding above the short-term( 21- EMA), 55 EMA, and the long-term moving average of 1.34573 (200- EMA). Any violation below 1.3570 confirms intraday bearishness. A dip to 1.3530/1.3470/1.3435 is possible.

WTI crude oil regained above the $76 level in hopes of strong China growth. Any daily close above $78.20 confirms minor bullishness.

The near-term resistance is around 1.36650 and any breach above targets is 1.37250/1.3800.

Indicators (4-Hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to buy on dips around 1.3570 with SL around 1.3500 for a TP of 1.37250.