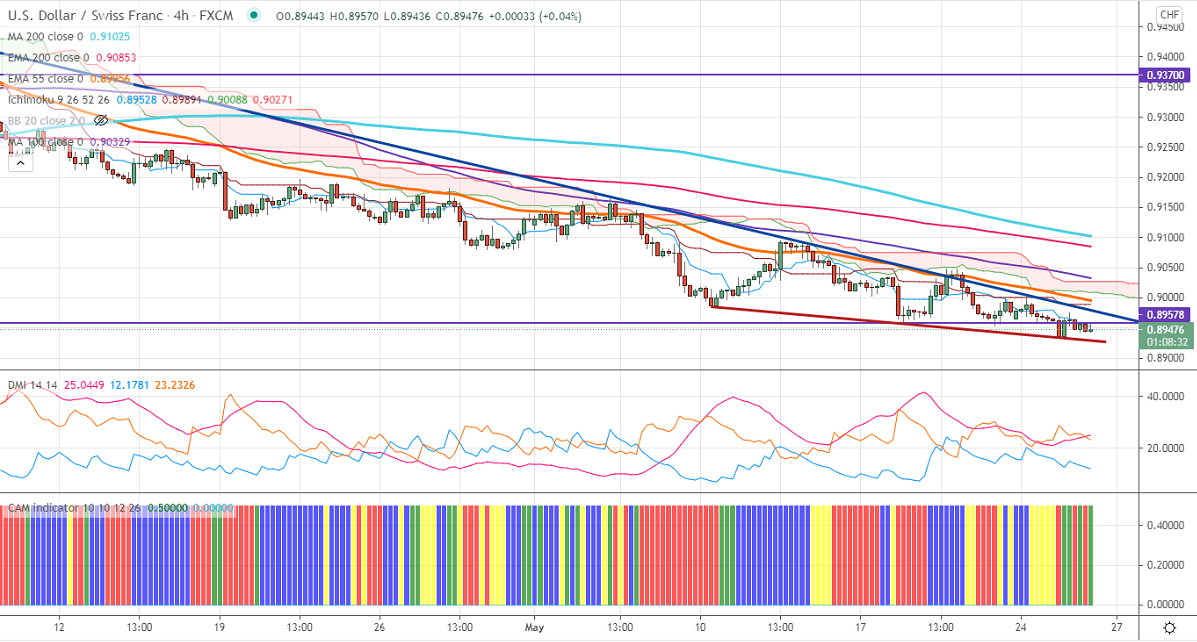

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 0.89528

Kijun-Sen- 0.89891

USDCHF is consolidating in a narrow range between 0.9001 and 0.89341 for the past three days. The pair was the worst performer for the past seven-week and lost more than 450 pips on US dollar weakness. The dovish comments from Fed members show that the central bank is expected to continue the accommodative monetary policy. The US 10- year yield declined more than 8% from minor top 1.692%. The conference board consumer confidence eased to 117.2 in May compared to a forecast of 118.80. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding well below 4- Hour Kijun-Sen, Tenken-Sen, and cloud. The near-term support is around 0.8920. Any close below 0.8920 will take the pair to next level to 0.8900/0.8870/0.8835. On the higher side, near-term resistance is around 0.8960. Any breach above targets 0.900/0.9040/0.9075.

Indicator (4-Hour chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 0.8970 with SL around 0.9010 for a TP of 0.8900.