The moment of truth will strike for the Lira on 24th July. Because then the next interest rate decision of the central bank is due.

The Central Bank of Republic of Turkey raised its benchmark interest rate by 125bps to 17.75 percent on June 7th, after a surprise 300bps hike last month to support the lira. Also, policymakers said further monetary tightening will be delivered, if needed. Latest data showed the country's annual inflation jumped to 12.15 percent in May, the second-highest since February 2004, due to higher energy prices and a tumbling currency.

If, at the end of July, what President Erdogan said yesterday proves true, namely that interest rates will fall in the period ahead, the collapse of the lira we saw yesterday is probably just a ridiculous copy of what it might face on 24 July. In this case, capital controls might prove to be unavoidable.

While this outcome is positive for producing a relatively stable government, the risks to the central bank and monetary policy, and hence, the lira outlook have multiplied. Our FX Hotspot from earlier today recaps the main points.

While we hold off moving UW with the CBRT surprising once again. The aggressive 500bps of tightening cumulatively delivered since April 25th is supportive for the currency in the first instance, however, we see a portion of it as merely “catching up”, with inflation accelerating.

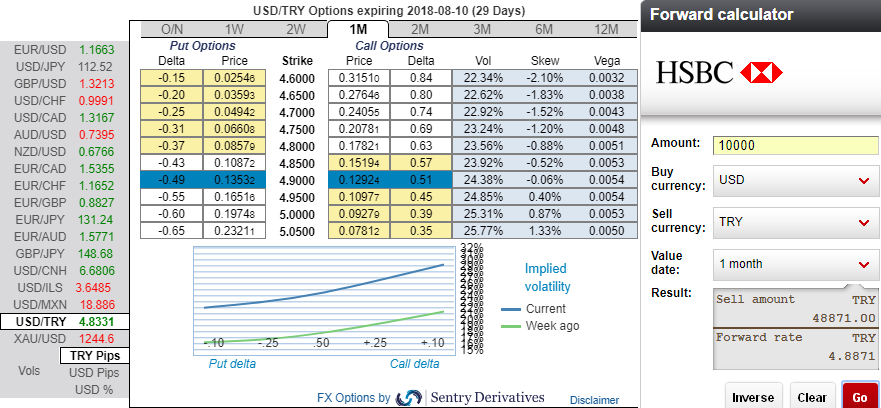

At spot reference: 4.8350 levels, please be noted that the positively skewed IVs and forward rates of 1m USDTRY contracts indicate mounting bullish risks (refer above nutshell for IV skews and forward rates).

Despite today's bearish swings, USDTRY edging higher all-time highs, contemplating above driving factors, on hedging grounds we initiate RV trade - 3m USDTRY put up-and-in Short 1m put.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 73 (which is bullish) while articulating at 12:40 GMT.

For more details on the index, please refer below weblink:

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation