We had already anticipated bear swings of this pair and recommended hedging strategies accordingly in the recent past, rest is history by now. For more reading on our previous write up please refer to the below webklinks:

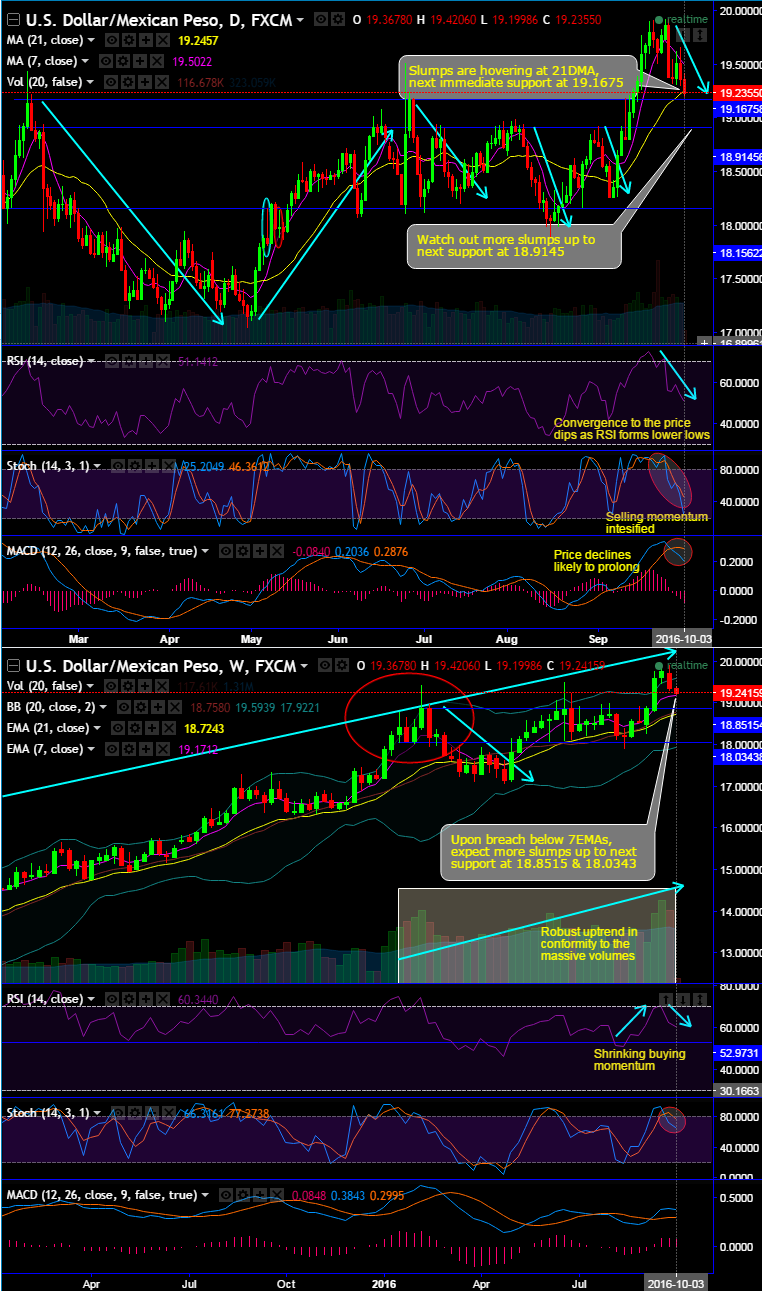

On daily charts of USDMXN, from last week onwards, the bull trend seems to have taken a halt ever since it has dropped from the highs of 19.922 levels, and from then you are seeing considerable price dips.

Currently, the bears are hovering at 21DMAs and attempting slip below 19.2461 levels.

Thereafter, upon any break below 19.1675 levels decisively and its sustenance, we foresee more slumps up to next strong support at 18.9145 levels.

The current prices have bent down above 7DMAs already and it seems like more chances slipping below 21DMA as well.

RSI and Stochastic on the other hand signals overbought pressures as they converge to these price dips as selling momentum seems to be intensified.

While MACD signals this bearish trend likely to prevail further.

Although average volumes are in conformity to the long-term rallies, leading oscillators flashing with little weakness at the current juncture as the selling signals pop up above overbought territories (see monthly charts). The major uptrend now seems to be little baffling with some bearish pressures.

We’ve seen a volume confirmation as well with these price declines even monthly plotting from last month.

So for long both short and medium term investors longs are not encouraged. Alternatively, on intraday speculative grounds the best way to approach this pair is to deploy below advocated binary option strategy.

Trade tips: We reckon it wise to capture deceptive rallies and stay short, as a result of above technical reasoning we see tunnel spreads which are binary versions of debit put spreads seems more conducive for speculators.

This strategy is best suitable for certain yields but with leveraging effects. Well, keep upper strikes for longs depending on your risk appetite and 19.1675 lower strikes, this is just for an intraday trading perspective, but in long run, technically this is certainly not yet an ideal time for fresh longs as stated above.

Recent articles on this pair: