Today’s rate meeting should see rates left on hold at 4.25% by Banxico. At the June meeting, Banxico raised rates by a surprising 50 bps and in the meantime MXN at least didn’t depreciate further.

The central bank of Mexico raised its benchmark interest rate by 50bps to 4.25 pct on June 30th 2016, aiming to contain inflationary pressures that may arise from peso depreciation.

This is despite the slide in the oil price, which implies that higher rates are having the desired effect upon the currency.

Given a generally subdued inflation profile, Banxico should be in no rush to raise rates further. We think there is scope for one more rate hike of 25 bps but this is likely to happen at year end rather than in this quarter. Even then, the hike would only be in response to higher US rates, not necessarily because of increasing inflation in Mexico.

Hedging Strategy:

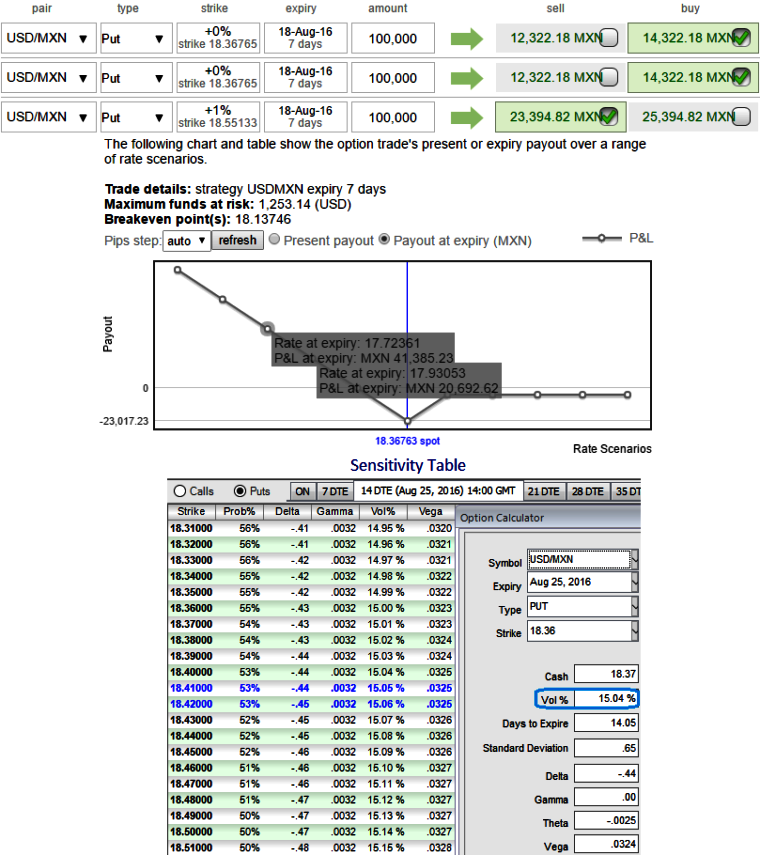

FX OTC market for USDMXN is intensified ahead of above fundamental scenario, 2W IVs are spiking above 15%. During such scenarios, Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility. Vega is generally larger in options which have a longer time until expiry, and it falls as the option approaches expiry.

As we expect the underlying currency exchange rate of USDMXN to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

Please be noted that the expiries shown in the diagram are for the demonstration purpose only, use appropriate tenors as stated above.

All told today’s meeting should be a non-event, but with Banxico there is always tail risk so long IRS positions offer a compelling risk reward, if only for the day.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says